How to Invest in Brazil Real Estate: Your Complete Guide to Profitable Property Investment in 2025

Brazil’s real estate market is experiencing a remarkable transformation in 2025, attracting savvy international investors who recognize the tremendous opportunities in South America’s largest economy. With property values appreciating in key markets, favorable exchange rates for foreign buyers, and a growing middle class driving demand, learning how to invest in Brazil real estate has never been more timely or potentially lucrative. Whether you’re seeking rental income from vacation properties in Florianópolis or long-term capital appreciation in São Paulo’s commercial sector, the Brazilian property market offers diverse pathways to building wealth.

Key Takeaways

- 🏖️ Strategic location selection is critical—coastal cities like Florianópolis offer high rental yields while major metros provide stable appreciation

- 📋 Foreign investors must obtain a CPF (Brazilian tax ID) and can purchase property with the same rights as Brazilian citizens, although some restrictions apply to border and coastal areas

- 💰 Pre-construction investments typically offer 20-30% appreciation potential before completion, making off-plan purchases particularly attractive

- 🏗️ Working with established developers like Quadragon ensures quality construction, legal compliance, and transparent transaction processes

- 📊 Market timing matters —2025 presents favorable conditions with economic stabilization and infrastructure development driving property values upward

Understanding the Brazilian Real Estate Market in 2025

The Brazilian property landscape has evolved significantly, presenting unique opportunities for both domestic and international investors. The market’s resilience despite economic fluctuations demonstrates the underlying strength of real estate as an asset class in Brazil.

Current Market Conditions

Brazil’s real estate sector in 2025 shows robust growth indicators across multiple segments. The Florianópolis real estate market is experiencing particularly strong performance , with sales momentum accelerating throughout the year. Property values in prime locations have appreciated by 8-12% annually, outpacing inflation and providing real returns to investors [1].

The residential segment continues to dominate investment activity, accounting for approximately 65% of all real estate transactions. However, commercial properties and mixed-use developments are gaining traction as urban centers modernize and expand.

Why International Investors Choose Brazil

Several compelling factors make Brazil an attractive destination for real estate investment:

Economic fundamentals : Despite historical volatility, Brazil’s economy shows stabilization with controlled inflation and improving fiscal policies. The country’s GDP growth projections for 2025 remain positive, supporting property demand [2].

Demographic trends : With over 215 million people and a growing middle class, housing demand continues to rise. Urbanization rates exceed 87%, concentrating population in cities where real estate values appreciate most rapidly.

Tourism boom : Brazil attracts over 6 million international tourists annually, creating strong demand for short-term rental properties in coastal and cultural destinations.

Currency advantages : For investors holding US dollars, euros, or other strong currencies, the Brazilian Real (BRL) exchange rate often provides favorable entry points, effectively reducing purchase costs.

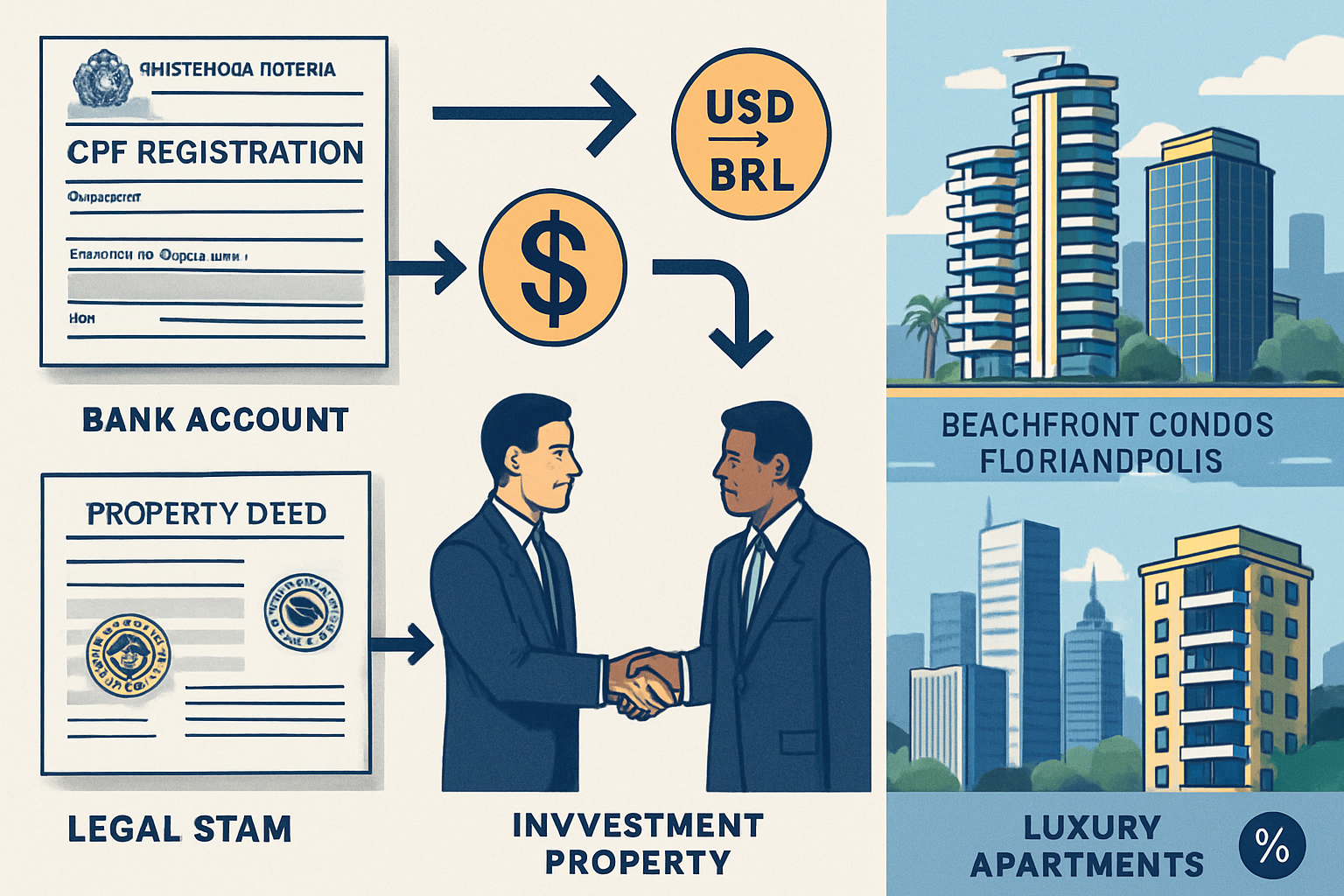

Legal Requirements: How to Invest in Brazil Real Estate as a Foreigner

Understanding the legal framework is essential when considering how to invest in Brazil real estate from abroad. Brazil maintains relatively open policies for foreign property ownership, although specific requirements must be met.

Documentation and Registration

CPF (Individual Person Registry) : Every foreign investor must obtain a CPF, Brazil’s tax identification number. This 11-digit number is essential for all financial transactions, including property purchases. The application process is straightforward and can often be completed through Brazilian consulates abroad or online [3].

Passport and identification : Valid passport documentation is required throughout the purchase process. Some transactions may require notarized translations of identification.

Proof of funds : Investors must demonstrate the legal origin of funds used for property purchases. Bank statements, income documentation, or investment account records typically satisfy this requirement.

Ownership Restrictions and Rights

Foreign individuals and companies enjoy nearly identical property rights as Brazilian citizens, with specific exceptions:

- Rural properties : Foreigners face restrictions on purchasing rural land, particularly parcels exceeding certain size thresholds

- Border and coastal zones : Properties within 150 kilometers of international borders or in designated coastal security zones require special authorization

- Urban residential and commercial : No restrictions apply to most city properties, condominiums, and commercial buildings

Foreign investors can hold property titles directly in their names, establish Brazilian companies for property holdings, or invest through real estate investment trusts (FIIs—Fundos de Investimento Imobiliário).

Opening a Brazilian Bank Account

While not always mandatory, establishing a Brazilian bank account significantly simplifies property transactions, utility payments, and rental income collection. Major banks like Banco do Brasil, Itaú, and Bradesco offer accounts to non-residents, although requirements vary:

- Valid passport and CPF

- Proof of address (both foreign and Brazilian if applicable)

- Initial deposit amounts varying by institution

- In-person visit often required, although some banks accommodate remote account opening

Step-by-Step Guide: How to Invest in Brazil Real Estate Successfully

Navigating the Brazilian property market requires systematic planning and execution. This comprehensive approach minimizes risks while maximizing investment returns.

Step 1: Define Your Investment Strategy

Determine your objectives : Are you seeking rental income, capital appreciation, vacation property, or portfolio diversification? Each goal influences property type, location, and holding period.

Set your budget : Consider not only purchase price but also transaction costs (typically 4-6% of property value), ongoing maintenance, property taxes (IPTU), and potential renovation expenses.

Choose your investment type :

- Pre-construction properties : Higher risk but potentially 20-30% appreciation before completion

- Completed properties : Immediate rental income potential with lower uncertainty

- Vacation rentals : Higher yields but more management intensive

- Commercial properties : Longer lease terms and stable corporate tenants

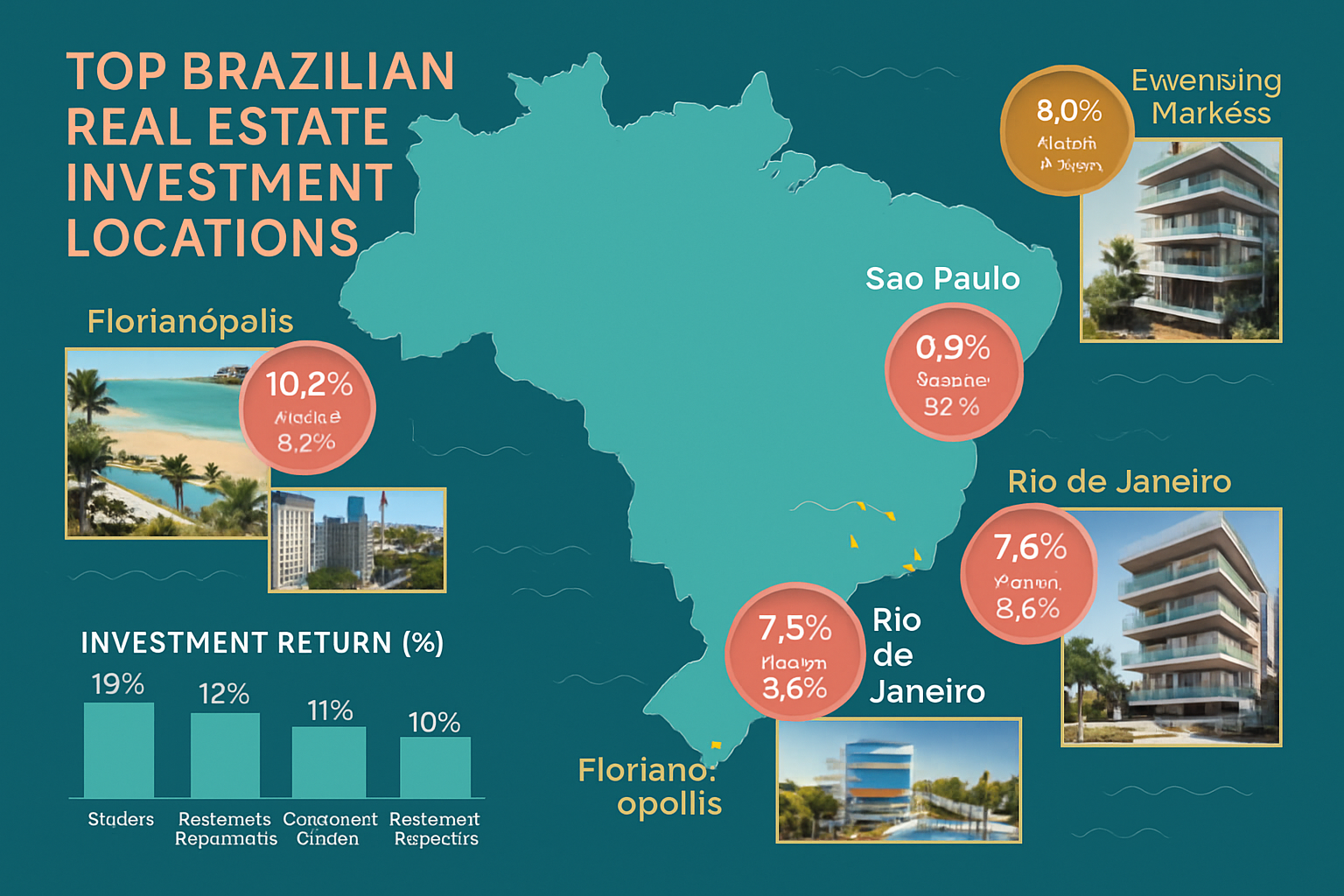

Step 2: Select the Right Location

Location determines both appreciation potential and rental yields. Brazil offers several prime investment locations , each with distinct characteristics:

| City | Property Type | Average Yield | Appreciation Potential | Best For |

|---|---|---|---|---|

| Florianópolis | Beach condos, studios | 6-9% | High | Vacation rentals, lifestyle |

| São Paulo | Commercial, residential | 4-6% | Moderate-High | Long-term appreciation |

| Rio de Janeiro | Luxury apartments | 5-7% | Moderate | Tourism, prestige |

| Curitiba | Residential | 5-6% | Moderate | Stable returns |

| Belo Horizonte | Mixed-use | 5-7% | Moderate | Emerging market |

The Ingleses region in Florianópolis exemplifies a high-growth area combining infrastructure development, quality of life, and property appreciation.

Step 3: Research Developers and Properties

Due diligence on developers : Work with established, reputable developers with proven track records. Verify:

- Company registration and legal standing

- Previous project completions and quality

- Financial stability and funding sources

- Customer reviews and testimonials

Established developers like Quadragon provide transparency, quality construction, and reliable project delivery timelines.

Property inspection : Whether buying off-plan or completed properties, thorough inspection is essential:

- Review architectural plans and specifications

- Verify building permits and legal compliance

- Assess location amenities and accessibility

- Evaluate construction quality and materials

Step 4: Engage Professional Services

Real estate attorney : Brazilian property law is complex. A qualified attorney ensures:

- Title verification and clean ownership chain

- Contract review and negotiation

- Proper registration with the Real Estate Registry (Cartório de Registro de Imóveis)

- Tax compliance and structuring

Real estate agent : Licensed agents (brokers) provide market knowledge, property access, and negotiation support. Commission rates typically range from 3-6% of purchase price, usually paid by the seller.

Accountant : For ongoing tax compliance, rental income reporting, and optimization of tax obligations, a Brazilian family accountant with foreign investor requirements is invaluable.

Step 5: Make an Offer and Negotiate

Brazilian property transactions follow established protocols:

- Initial proposal : Submit a written offer specifying price, payment terms, and conditions

- Negotiation : Expect counteroffers; property prices are often negotiable, particularly for cash purchases

- Reservation agreement : Upon acceptance, sign a reservation contract with a deposit (typically 1-5% of purchase price)

- Due diligence period : Use this time for final inspections, title verification, and legal review

Step 6: Execute the Purchase Agreement

The promissory purchase and sale agreement is the primary contract:

- Details all terms, conditions, payment schedule, and delivery

- Registered with the Real Estate Registry for legal protection

- Typically requires 10-30% down payment for off-plan properties

- Specifies penalties for breach by either party

Payment structure for pre-construction properties often includes:

- Down payment: 10-30%

- Monthly installments during construction: 40-60%

- Final payment upon delivery: 20-30%

Step 7: Complete the Transaction

Upon property completion or for ready properties:

Final inspection : Verify all specifications match the contract and identify any defects requiring correction.

Deed signing : The final deed (Escritura Pública) is signed before a notary public, transferring legal ownership.

Registration : The deed must be registered at the Real Estate Registry to complete the legal transfer.

Tax payments : Transfer taxes (ITBI—Imposto de Transmissão de Bens Imóveis) typically range from 2-3% of the property value, paid by the buyer.

Financing Options for Foreign Investors

Securing financing as a foreign investor in Brazil presents challenges, as most banks require permanent residency for mortgage approval. However, several alternatives exist:

Developer financing

Many Brazilian developers offer in-house financing for pre-construction properties, particularly appealing to foreign buyers:

- No residency requirements

- Flexible payment plans during construction

- Interest rates typically 8-12% annually

- Down payments from 20-30%

Investing in pre-construction properties through established developers provides structured payment options aligned with construction milestones.

International financing

Some investors secure financing in their home countries using existing assets as collateral, then purchase Brazilian property with cash. This approach offers:

- Potentially lower interest rates

- Familiar legal framework

- Simplified approval process

- Tax advantages in some jurisdictions

Cash purchases

The majority of foreign investors purchase Brazilian property outright with cash, offering advantages:

- Stronger negotiating position (10-15% discounts possible)

- No interest costs or financing fees

- Faster transaction completion

- Simplified legal process

Tax Considerations and Obligations

Understanding Brazilian tax obligations is crucial for how to invest in Brazil real estate profitably and legally.

Property taxes

IPTU (Urban Property and Territorial Tax) : Annual property tax based on assessed value, typically 0.3-1.5% depending on location and property type. Paid monthly or annually to municipal governments.

Income taxes on rental revenue

Rental income is taxable in Brazil regardless of the owner’s residency status:

- Progressive rates from 15-27.5% for individuals

- Monthly payments required through the Carnê-Leão system

- Deductions allowed for maintenance, property management, and depreciation

- Tax treaties between Brazil and investor’s home country may affect obligations

Capital gains tax

Property sale profits are subject to capital gains tax:

- 15% rate on gains up to R$5 million

- Higher rates for larger gains

- Examples available if proceeds are reinvested in another Brazilian property within 180 days

- Cost basis includes purchase price, improvements, and transaction costs

Withholding taxes

Foreign property owners face withholding tax on certain transactions:

- 15% on rental income if paid to non-residents

- 15-25% on sale proceeds for non-residents

- Proper tax registration and compliance can minimize withholding

Managing Your Brazilian Property Investment

Successful property investment extends beyond acquisition to effective ongoing management.

Property management options

Self-management : Viable only for investors residing in Brazil or visiting frequently. Responsibilities include:

- Tenant screening and lease agreements

- Rent collection and accounting

- Maintenance coordination

- Legal compliance

Professional management companies : Most foreign investors engage local property managers who handle:

- Marketing and tenant placement

- Rent collection and remittance

- Maintenance and repairs

- Legal and regulatory compliance

- Financial reporting

Management fees typically range from 8-12% of monthly rental income, with additional charges for tenant placement.

Vacation rental management

For short-term rental properties in tourist destinations, specialized vacation rental managers provide:

- Listing on platforms (Airbnb, Booking.com, VRBO)

- Guest communication and check-in services

- Cleaning and maintenance between stays

- Dynamic pricing optimization

- Higher fees (20-30% of rental revenue) reflecting additional services

Studio apartments in Florianópolis are particularly well-suited for vacation rental strategies, offering strong yields in high-demand locations.

Maintenance and upkeep

Condominium fees : Multi-unit buildings charge monthly fees covering:

- Common area maintenance

- Security services

- Building insurance

- Reserve fund contributions

- Amenity upkeep (pools, gyms, etc.)

Fees vary widely based on building quality and amenities, typically R$300-1,500 monthly for residential properties.

Regular maintenance : Budget 1-2% of property value annually for repairs, painting, appliance replacement, and preventive maintenance.

Emerging Opportunities in Brazilian Real Estate

The Brazilian property market continues evolving, creating new investment niches and opportunities.

Pre-construction investments

Buying off-plan properties offers significant advantages:

- Lower entry prices : Pre-construction properties sell at 15-25% below completed market value

- Appreciation during construction : Properties typically appreciate 20-30% from launch to delivery

- Flexible payment terms : Developer financing spreads payments over 24-36 months

- Customization options : Early buyers may select finishes and layouts

Projects like Tramonto demonstrate the quality and potential of well-executed pre-construction developments.

Cryptocurrency and real estate

Cryptocurrency is increasingly intersecting with real estate development , offering innovative investment structures:

- Some developers accepting cryptocurrency payments

- Blockchain-based property tokenization

- Smart contracts for automated transactions

- International payment facilitation

Sustainable and eco-friendly developments

Environmental consciousness is driving demand for:

- LEED-certified buildings

- Solar energy integration

- Water conservation systems

- Green spaces and sustainable materials

Properties with sustainability features command premium prices and attract environmentally conscious tenants.

Co-living and co-working spaces

Changing lifestyle preferences, particularly among younger demographics, create opportunities in:

- Furnished studios with shared amenities

- Mixed-use developments combining residential and workspace

- Flexible lease terms catering to digital nomads

- Community-focused design

Risk Management and Common Pitfalls

Understanding potential challenges helps investors avoid costly mistakes when learning how to invest in Brazil real estate .

Currency fluctuation risk

The Brazilian Real’s volatility against major currencies can significantly impact returns:

Mitigation strategies :

- Purchase during favorable exchange rate periods

- Generate rental income in Reals to match currency exposure

- Consider long-term holding periods to weather fluctuations

- Hedge currency risk through financial instruments if holding large positions

Legal and title issues

Title verification : Always conduct comprehensive title searches to ensure:

- Clear ownership chain without disputes

- No outstanding liens or ecumbrances

- Proper registration and documentation

- Compliance with zoning and building regulations

Legal representation : Never proceed without qualified legal counsel familiar with foreign investor transactions.

Developer reliability

Red flags indicating potential developer problems:

- Delayed previous projects

- Unclear ownership structure

- Inadequate financial backing

- Unrealistic timelines or promises

- Lack of proper permits and approvals

Verification steps :

- Research company history and track record

- Visit completed projects

- Review financial statements if available

- Check for complaints with consumer protection agencies

- Verify all permits and legal compliance

Market timing and liquidity

Real estate is inherently illiquid. Consider:

- Holding period : Plan for minimum 3-5 year investment horizon

- Exit strategy : Identify potential buyers or rental markets before purchasing

- Market cycles : Brazil’s real estate market experiences cycles; avoid buying at peaks

- Economic conditions : Monitor Brazilian economic indicators affecting property values

Overestimating rental yields

Realistic expectations prevent disappointment:

- Vacancy periods : Budget for 1-2 months vacancy annually

- Management costs : Factor in 8-12% management fees

- Maintenance : Unexpected repairs can significantly impact returns

- Market saturation : Popular tourist areas may face increasing competition

Working with Quadragon: A Case Study in Quality Development

Quadragon exemplifies the type of established developer that foreign investors should seek when entering the Brazilian market. With a proven track record in Florianópolis, the company demonstrates several best practices:

Transparent development process

Quadragon maintains regular construction updates , allowing investors to monitor progress and timeline adherence. This transparency builds confidence and demonstrates professional project management.

Quality project portfolio

The company’s diverse development portfolio includes properties like Solis , showcasing attention to design, location selection, and amenity integration that appeals to both investors and end-users.

Market expertise

Quadragon’s insights into Florianópolis market dynamics demonstrate deep local knowledge essential for identifying high-potential investment opportunities.

Investor support

From initial inquiry through property delivery and beyond, established developers provide:

- Legal documentation assistance

- Connection to qualified service providers

- After-sales support and warranty fulfillment

- Accessible communication channels for investor questions

Lifestyle Considerations: Living in Brazil

For investors considering personal use of their Brazilian property, understanding the lifestyle offers additional context.

Quality of life

Life in Florianópolis and other Brazilian cities offers:

- 🌴 Climate : Tropical and subtropical climates with warm temperatures year-round

- 🏖️ Beaches : World-class coastal areas for recreation and relaxation

- 🎭 Culture : Rich cultural heritage, festivals, music, and cuisine

- 👥 Social environment : Welcoming, friendly population

- 💰 Cost of living : Generally lower than North American and European cities

Visa and residency options

While property ownership doesn’t automatically grant residency, several visa options exist:

- Investor visa : Available for significant investments (typically R$500,000+)

- Retirement visa : For retirees with guaranteed monthly income

- Temporary visa : For extended stays up to 2 years

- Digital nomad visa : Recently introduced for remote workers

Healthcare and education

Brazil offers both public and private healthcare systems, with private health insurance providing excellent care at reasonable costs. International schools are available in major cities for families with children.

Conclusion: Your Path to Successful Brazilian Real Estate Investment

Learning how to invest in Brazil real estate opens doors to a dynamic market offering compelling returns, portfolio diversification, and potential lifestyle benefits. The combination of growing demand, favorable demographics, and strategic locations creates opportunities for both income generation and capital appreciation.

Your Next Steps

1. Define your investment criteria : Clarify objectives, budget, and preferred property types and locations.

2. Research thoroughly : Study market conditions, legal requirements, and available developments matching your criteria.

3. Build your team : Engage qualified professionals including attorneys, accountants, and real estate agents experienced with foreign investors.

4. Visit Brazil : If possible, visit your target investment area to understand the market firsthand, meet developers, and inspect properties.

5. Start conservatively : Consider beginning with a single property to learn the market before expanding your portfolio.

6. Stay informed : Monitor market news and trends to identify emerging opportunities and potential challenges.

The Brazilian real estate market rewards informed, patient investors who conduct proper due diligence and work with reputable partners. Whether you’re seeking vacation rental income from coastal properties, long-term appreciation in greater meters, or pre-construction opportunities with established developers, Brazil offers diverse pathways to building wealth through property investment.

By following the comprehensive guidance outlined in this article, understanding legal requirements, managing risks effectively, and partnering with experienced professionals, you can successfully navigate the Brazilian property market and build a profitable real estate portfolio in one of South America’s most dynamic economies.

The time to explore Brazilian real estate opportunities is now—with favorable market conditions, infrastructure development, and growing international interest, 2025 presents an excellent entry point for strategic investors ready to capitalize on Brazil’s property potential.

References

[1] Brazilian Real Estate Market Report, 2025, National Association of Real Estate Developers (ABRAINC)

[2] International Monetary Fund, Brazil Economic Outlook 2025

[3] Brazilian Federal Revenue Service, CPF Registration Guidelines for Foreign Nationals