Florianopolis Real Estate Investment: Your Complete Guide to Brazil’s Coastal Property Market in 2026

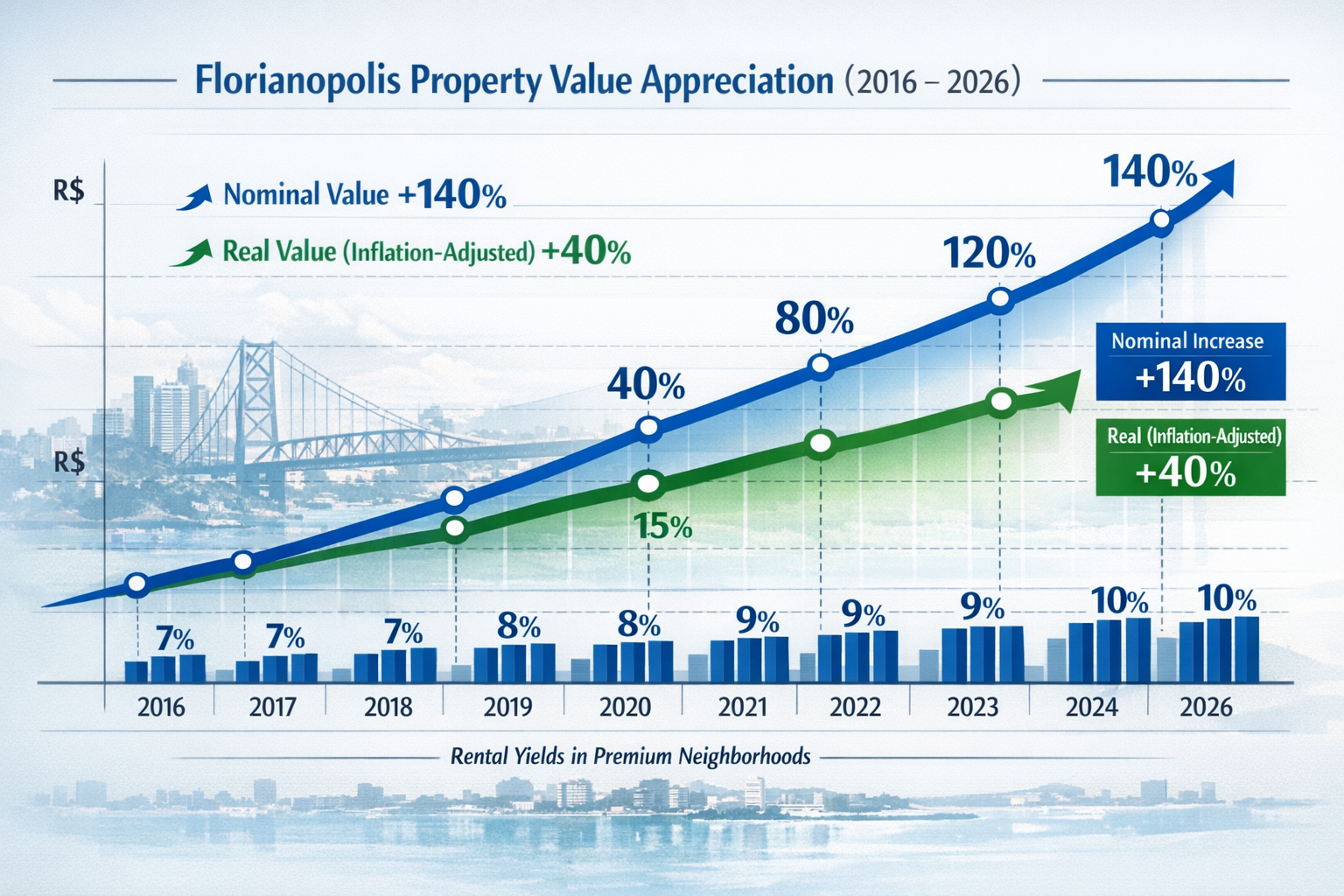

Imagine owning a slice of paradise where pristine beaches meet modern infrastructure, where property values have surged 140% over the past decade, and where annual rental yields consistently reach 7-10%. Welcome to Florianopolis, Brazil’s island capital that has quietly become one of South America’s most compelling real estate investment destinations. As international investors increasingly look beyond traditional markets, Florianopolis real estate investment has emerged as a strategic opportunity combining lifestyle appeal with robust financial returns.

This comprehensive guide explores everything investors need to know about entering the Florianopolis property market, from current pricing dynamics and neighborhood analysis to practical investment strategies and legal considerations for foreign buyers.

Key Takeaways

- Strong appreciation trajectory: Florianopolis properties have increased 140% in nominal terms over the past decade, with real appreciation of 40% after inflation adjustment[1]

- Attractive rental yields: Premium neighborhoods like Jurerê Internacional consistently deliver 7-10% annual rental returns, while Trindade offers yields up to 7.35%[1][3]

- Accessible entry points: Investment opportunities start around R$350,000 (approximately $63,000 USD) for older studios in emerging neighborhoods[1]

- Market diversity: 80% of residential properties fall within the R$500,000 to R$1,600,000 range, offering options for various investment budgets[1]

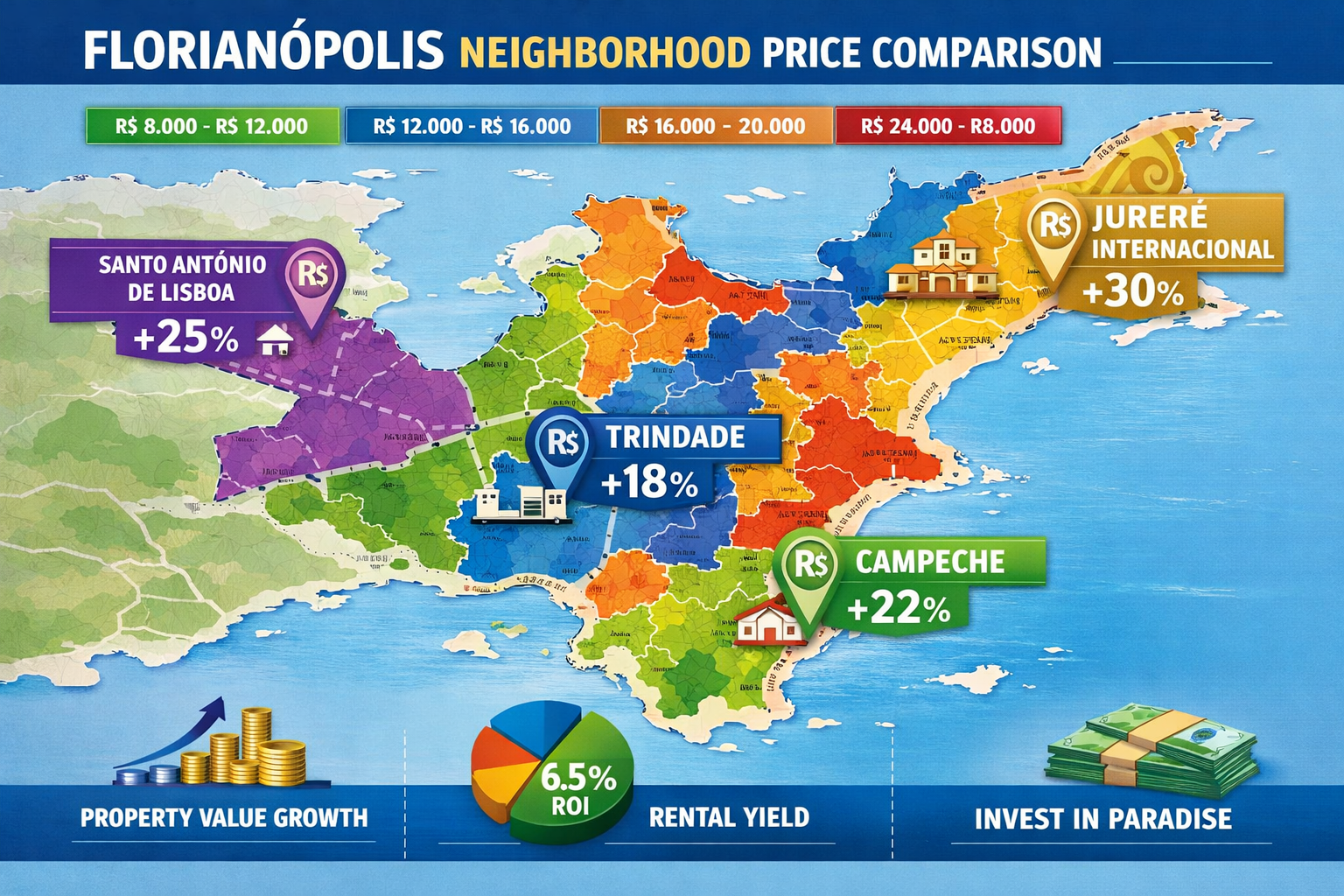

- Emerging hotspots: Neighborhoods like Campeche and Santo Antônio de Lisboa are experiencing double-digit price growth, presenting early-stage investment opportunities[2]

Understanding the Florianopolis Real Estate Market in 2026

Current Market Fundamentals

The Florianopolis property market has demonstrated remarkable resilience and growth, establishing itself as a premier destination for both domestic and international real estate investors. As of 2026, the average price per square meter stands at R$12,710 (approximately $2,290 USD), with a median of R$11,750 (approximately $2,117 USD)[1]. These figures reflect a market that has matured significantly while maintaining accessibility for strategic investors.

The real estate market in Florianopolis has shown consistent upward momentum, with housing prices rising 8% in nominal terms over the past 12 months. When adjusted for Brazil’s inflation rate, the real appreciation stands at a healthy 3.5%[1], indicating genuine market strength beyond monetary expansion.

Price Distribution and Market Segmentation

Understanding where properties fall within the pricing spectrum is crucial for Florianopolis real estate investment strategy:

| Price Range (BRL) | Price Range (USD) | Market Share | Property Types |

|---|---|---|---|

| Below R$500,000 | Below $90,000 | ~10% | Older studios, small apartments |

| R$500,000 – R$1,600,000 | $90,000 – $288,000 | ~80% | Standard apartments, houses |

| Above R$1,600,000 | Above $288,000 | ~10% | Luxury properties, beachfront |

This distribution reveals that the majority of investment opportunities exist in the mid-market segment, where properties offer the best balance between acquisition cost and appreciation potential[1].

Property Type Composition

The Florianopolis market shows a clear preference for apartment living, with standard apartments comprising 62% of the housing market, while standalone houses represent just 18% of listings[1]. This urban density reflects the island’s geography and the growing demand for modern amenities and security features that apartment complexes provide.

Interestingly, new-build homes command an 18% price premium over comparable older properties, driven by modern amenities, energy efficiency, and lower anticipated maintenance costs[1]. For investors considering buying off-plan properties, this premium represents both a cost consideration and a value proposition.

Prime Neighborhoods for Florianopolis Real Estate Investment

Jurerê Internacional: The Premium Investment Hub 🏖️

Jurerê Internacional stands as the undisputed champion of Florianopolis luxury real estate. This meticulously planned beachfront community commands asking prices ranging from R$18,000 to R$28,000 per square meter—significantly above the city average[1][3].

What makes Jurerê Internacional particularly attractive for investors:

- Exceptional rental yields: 7-10% annually, among the highest on the island[3]

- Strong appreciation: 15-20% per year for foreign investors[3]

- Premium amenities: Beach clubs, upscale restaurants, and world-class infrastructure

- International appeal: Attracts affluent Brazilian and foreign tourists year-round

- Rental demand: Consistent high-season and shoulder-season occupancy

The neighborhood’s sophisticated infrastructure and international reputation make it ideal for investors seeking premium returns with lower vacancy risk.

Campeche: The Emerging Growth Story 📈

For investors seeking early-stage appreciation opportunities, Campeche represents compelling value. This southern neighborhood experienced 15% price growth in 2023 alone, with projections indicating continued 10% annual appreciation[2].

Campeche’s investment appeal includes:

- Natural beauty: Pristine beaches with less development density

- Infrastructure improvements: Ongoing road and utility upgrades

- Growing demand: Increasingly popular with young families and remote workers

- Value positioning: Lower entry prices than established northern neighborhoods

- Development pipeline: New residential projects attracting attention

The growth in the Ingleses region demonstrates similar patterns that investors saw in Campeche’s early stages, making it a neighborhood to watch closely.

Trindade: The Rental Yield Champion 🎓

Trindade offers the highest gross rental yields in Florianopolis at approximately 7.35%[1], driven by its strategic location near the Federal University of Santa Catarina (UFSC). This creates consistent demand from students, professors, and university staff.

Key investment considerations for Trindade:

- Stable tenant pool: University affiliation provides year-round demand

- Affordable entry: Lower purchase prices than beachfront neighborhoods

- Strong cash flow: Higher rental yields offset slower appreciation

- Diverse property types: Studios to family apartments available

- Established infrastructure: Mature neighborhood with complete amenities

For investors prioritizing immediate cash flow over long-term appreciation, Trindade presents an excellent opportunity. Those interested in studio investments will find Trindade particularly attractive.

Santo Antônio de Lisboa: The Heritage Investment 🏛️

This charming colonial neighborhood has posted a remarkable 21% increase in average asking prices over the past year[2], signaling strong investor interest in its unique character and waterfront location.

Santo Antônio de Lisboa offers:

- Cultural appeal: Historic architecture and traditional fishing village atmosphere

- Gastronomic reputation: Renowned restaurants attracting tourists and locals

- Waterfront properties: Bay views and sunset vistas

- Limited supply: Historic preservation limits new construction

- Appreciation potential: Scarcity driving continued price growth

This neighborhood appeals to investors seeking character properties with strong appreciation prospects rather than maximum rental yields.

Ingleses: The Accessible Entry Point 💰

For investors with limited capital or seeking portfolio diversification, Ingleses provides accessible entry points starting around R$350,000 (approximately $63,000 USD) for older studios and small one-bedroom apartments[1].

Ingleses characteristics:

- Beach access: Popular swimming beach with good infrastructure

- Tourism activity: Seasonal rental potential during summer months

- Commercial development: Growing retail and service sector

- Transportation: Good connectivity to other island regions

- Investment flexibility: Range of property types and price points

Understanding life in Florianopolis helps investors appreciate why neighborhoods like Ingleses continue attracting both residents and tourists.

Financial Analysis: Returns and Costs

Historical Performance and Future Projections

The long-term growth trajectory of Florianopolis real estate provides confidence for future investment. Property prices have increased approximately 140% in nominal terms over the past decade, with real appreciation of 40% after accounting for cumulative inflation[1].

This performance significantly outpaces traditional savings vehicles and demonstrates the market’s fundamental strength. When compared to other top locations in Brazil for property investment, Florianopolis consistently ranks among the leaders in both appreciation and rental yields.

Transaction Costs and Negotiation Leverage

Understanding the complete cost structure is essential for accurate investment analysis:

Buyer closing costs typically add 3.5% to 6% to the purchase price, covering:

- Transfer taxes (ITBI – Imposto de Transmissão de Bens Imóveis)

- Notary fees and registration

- Legal documentation

- Property inspection (recommended)

However, buyers typically possess negotiation leverage, with successful negotiations averaging approximately 7% off listing prices[1]. This discount can effectively offset most or all closing costs, improving the investment’s entry economics.

Rental Income Potential

Rental yields vary significantly by neighborhood and property type:

| Neighborhood | Gross Rental Yield | Property Type | Market Characteristics |

|---|---|---|---|

| Jurerê Internacional | 7-10% | Luxury apartments | High-season premium, international tourists |

| Trindade | 7.35% | Studios/apartments | Year-round university demand |

| Campeche | 5-7% | Houses/apartments | Growing residential market |

| Ingleses | 6-8% | Apartments | Seasonal tourism, emerging year-round |

| Santo Antônio | 4-6% | Heritage properties | Weekend/holiday rentals |

These yields represent gross returns before expenses such as property management, maintenance, taxes, and vacancy periods. Net yields typically run 2-3 percentage points lower after accounting for these operational costs.

Tax Considerations for Investors

Brazilian property taxation includes several components:

- IPTU (Property Tax): Annual municipal tax, typically 0.5-1.5% of assessed value

- Rental Income Tax: Progressive rates for Brazilian residents; flat 15% for foreign owners

- Capital Gains Tax: 15% on profits from property sales (with exemptions available)

- Inheritance Tax: State-level tax ranging from 4-8%

Foreign investors should consult with Brazilian tax specialists to optimize their structure and ensure compliance with both Brazilian and home-country tax obligations.

Practical Strategies for Florianopolis Real Estate Investment

Strategy 1: Buy Off-Plan for Maximum Appreciation 🏗️

Purchasing properties during the construction phase offers several advantages:

- Lower entry prices: Developers offer discounts for early commitment

- Payment flexibility: Installment plans during construction period

- Appreciation during construction: Property values increase as completion approaches

- Modern specifications: Latest design trends and building standards

- Warranty coverage: New construction warranties protect against defects

The advantages of off-plan purchases can significantly enhance returns, particularly in high-growth neighborhoods like Campeche and emerging areas.

Strategy 2: Value-Add Renovations

Older properties in established neighborhoods present renovation opportunities that can unlock substantial value:

- Modernization premium: Updated properties command higher rents and sale prices

- Energy efficiency: Modern systems reduce operating costs

- Layout optimization: Reconfiguring spaces to meet current market preferences

- Aesthetic improvements: Contemporary finishes attract quality tenants

Properties in neighborhoods like Ingleses and Centro offer the best renovation potential, where the 18% new-build premium[1] creates a value gap that renovations can capture.

Strategy 3: Short-Term Rental Arbitrage

Florianopolis’s tourism economy creates opportunities for short-term rental strategies:

- Premium neighborhoods: Jurerê Internacional and Campeche attract vacation renters

- Platform leverage: Airbnb and VRBO provide marketing and booking infrastructure

- Seasonal optimization: High-season rates significantly exceed long-term rental income

- Professional management: Local property managers handle operations for foreign investors

However, investors must verify local regulations regarding short-term rentals, as some condominium associations restrict this practice.

Strategy 4: Portfolio Diversification Across Neighborhoods

Rather than concentrating capital in a single property, sophisticated investors often diversify across neighborhoods:

- Mix appreciation and yield: Combine high-growth areas (Campeche) with high-yield locations (Trindade)

- Risk mitigation: Different neighborhoods respond differently to market cycles

- Tenant diversity: Student, tourist, and professional tenant bases

- Liquidity options: Smaller properties typically sell faster when needed

This approach requires more management complexity but provides superior risk-adjusted returns over time.

Legal Framework for Foreign Investors

Property Ownership Rights

Foreign investors enjoy nearly identical property rights as Brazilian citizens, with few restrictions. Non-residents can freely purchase and own real estate in Florianopolis, with limited exceptions for properties in border security zones (not applicable to Florianopolis) and rural properties exceeding certain sizes[4].

Required Documentation

Foreign buyers must obtain a CPF (Cadastro de Pessoas Físicas), Brazil’s taxpayer identification number. This straightforward process can be completed at Brazilian consulates abroad or within Brazil. Additional requirements include:

- Valid passport

- Proof of address (home country)

- Marriage certificate (if applicable)

- Power of attorney (if not personally present for closing)

Financing Options

While financing property in Brazil for foreigners[4] is possible, it presents challenges:

- Limited availability: Most Brazilian banks require residency for mortgages

- Higher down payments: Foreign buyers typically need 40-50% down payment

- Higher interest rates: Non-resident rates exceed those for Brazilian citizens

- Currency considerations: Loans are denominated in Brazilian Reais

Most foreign investors purchase properties with cash or arrange financing in their home countries, avoiding Brazilian mortgage complexities.

Repatriation of Funds

Brazil allows free repatriation of capital and profits from real estate investments, provided proper documentation exists. Investors should:

- Register the foreign investment with the Central Bank of Brazil

- Maintain documentation of the original investment source

- Pay applicable capital gains taxes before repatriation

- Use authorized financial institutions for international transfers

Working with experienced legal counsel ensures compliance and smooth fund movements.

Market Trends Shaping 2026 and Beyond

Remote Work Migration

The global shift toward remote work has significantly impacted Florianopolis real estate demand. The city’s combination of excellent internet infrastructure, lower living costs compared to São Paulo or Rio de Janeiro, and outstanding quality of life attracts domestic and international remote workers.

This trend supports:

- Sustained rental demand for well-equipped apartments

- Preference for larger units with dedicated workspace

- Year-round occupancy rather than seasonal patterns

- Price support in residential neighborhoods

Infrastructure Development

Ongoing and planned infrastructure improvements continue enhancing property values:

- Road improvements: Better connectivity between neighborhoods

- Airport expansion: Increased international flight capacity

- Public transportation: Enhanced bus networks and potential metro planning

- Utility upgrades: Improved water, sewage, and electrical systems

These developments particularly benefit emerging neighborhoods where infrastructure gaps previously limited growth.

Sustainability and Eco-Conscious Development

Environmental consciousness increasingly influences buyer and renter preferences:

- Green building certifications: LEED and similar standards command premiums

- Solar energy: Photovoltaic installations reduce operating costs

- Water conservation: Rainwater harvesting and efficient fixtures

- Sustainable materials: Eco-friendly construction attracting premium tenants

Developers incorporating these features position their projects for superior performance in the evolving market.

Digital Innovation in Real Estate

Technology continues transforming how properties are marketed, sold, and managed:

- Virtual tours: 3D walkthroughs enabling remote purchasing decisions

- Blockchain: Emerging applications in property registration and transactions

- Smart home technology: IoT devices increasing property appeal

- Digital property management: Automated systems improving operational efficiency

Understanding how cryptocurrency intersects with real estate development provides insight into emerging payment and investment structures.

Risk Factors and Mitigation Strategies

Currency Volatility ⚠️

The Brazilian Real experiences significant fluctuations against major currencies, creating both opportunities and risks for foreign investors:

Mitigation approaches:

- Dollar-cost averaging: Invest incrementally rather than lump-sum

- Natural hedging: Earn rental income in Reais to offset currency exposure

- Long-term perspective: Currency fluctuations smooth over extended holding periods

- Diversification: Brazil as part of broader international portfolio

Economic and Political Uncertainty

Brazil’s economic and political environment can be volatile, impacting property markets:

Risk management:

- Focus on fundamentals: Supply-demand dynamics matter more than short-term politics

- Quality locations: Premium neighborhoods demonstrate greater resilience

- Conservative financing: Avoid excessive leverage magnifying downside risks

- Professional guidance: Local experts navigate changing conditions

Property Management Challenges

Absentee ownership presents operational challenges, particularly for foreign investors:

Solutions:

- Professional management companies: Local firms handle day-to-day operations

- Technology platforms: Remote monitoring and communication systems

- Trusted local contacts: Attorneys, accountants, and contractors

- Regular visits: Periodic inspections maintain property condition

Liquidity Considerations

Real estate is inherently less liquid than financial securities:

Liquidity planning:

- Appropriate time horizon: Plan for minimum 5-year holding periods

- Emergency reserves: Maintain separate liquid funds for unexpected needs

- Property selection: Smaller, well-located properties sell faster

- Pricing strategy: Realistic pricing accelerates sales when needed

Conclusion: Taking Action on Florianopolis Real Estate Investment

Florianopolis presents a compelling opportunity for real estate investors seeking the combination of lifestyle appeal, strong historical appreciation, and attractive rental yields. The market’s fundamentals—consistent price growth, diverse neighborhood options, and accessible entry points—create conditions favorable for both experienced and first-time international property investors.

The data clearly demonstrates that Florianopolis real estate investment has delivered substantial returns over the past decade, with 140% nominal appreciation[1] and rental yields consistently reaching 7-10% in premium locations[1][3]. As Brazil’s economy continues developing and Florianopolis solidifies its position as a premier coastal destination, these trends appear likely to continue.

Recommended Next Steps

For investors ready to explore Florianopolis opportunities:

- Define investment objectives: Clarify whether you prioritize appreciation, rental income, or personal use

- Research neighborhoods: Study the areas aligned with your strategy and budget

- Visit the market: Personal inspection provides invaluable insights

- Build professional team: Engage qualified attorneys, accountants, and property managers

- Start small: Consider initial investment to learn the market before scaling

- Monitor developments: Track new construction projects for off-plan opportunities

The combination of natural beauty, growing infrastructure, and favorable investment metrics makes Florianopolis one of Brazil’s most attractive real estate markets. Whether seeking a vacation property that generates income, a retirement destination, or purely financial returns, the island offers options across the investment spectrum.

Success in Florianopolis real estate investment requires understanding local market dynamics, selecting appropriate neighborhoods, structuring ownership correctly, and maintaining realistic expectations about returns and timelines. With proper preparation and professional guidance, investors can position themselves to benefit from this dynamic market’s continued growth throughout 2026 and beyond.

For personalized guidance on specific investment opportunities, contact local real estate specialists who can provide current market insights and property options aligned with your investment criteria.

References

[1] Florianopolis Housing Prices – https://thelatinvestor.com/blogs/news/florianopolis-housing-prices

[2] Florianopolis Which Area – https://thelatinvestor.com/blogs/news/florianopolis-which-area

[3] How Foreigners Florianopolis – https://thelatinvestor.com/blogs/news/how-foreigners-florianopolis

[4] Financing Property In Brazil For Foreigners – https://rocksinvestments.com/business/financing-property-in-brazil-for-foreigners/