ROI of Real Estate Investments in Brazil: A Comprehensive Guide for 2025

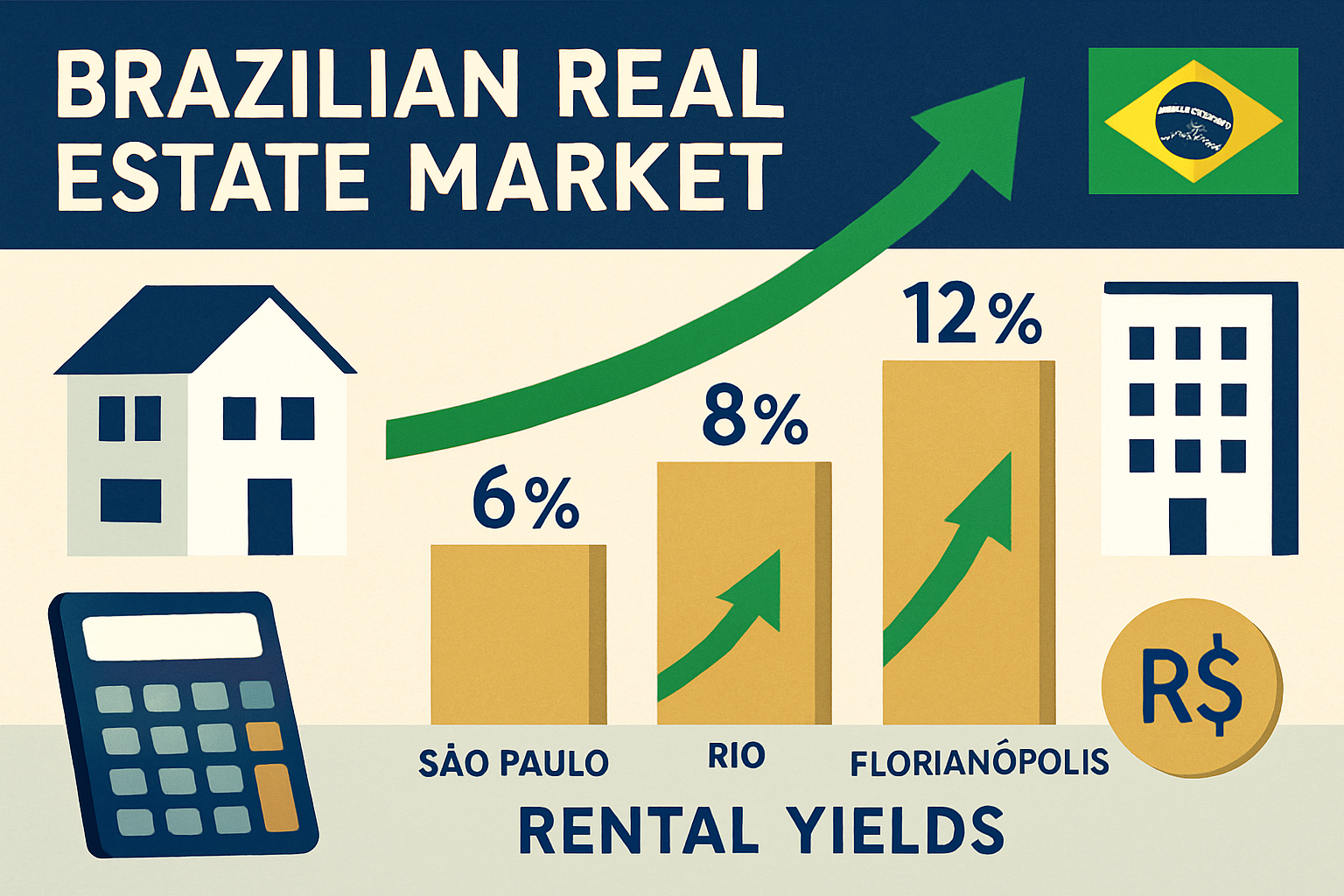

Brazil’s real estate market has emerged as one of Latin America’s most compelling investment opportunities, attracting both domestic and international investors seeking attractive returns. With rental yields ranging from 6% to 12% annually in key markets and property appreciation consistently outpacing inflation, understanding the ROI of Real Estate Investments in Brazil has become essential for anyone looking to diversify their portfolio or capitalize on emerging market opportunities.

The Brazilian property market offers unique advantages: a growing middle class, urbanization trends driving demand, favorable exchange rates for foreign investors, and specific regions experiencing unprecedented growth. Whether you’re considering residential properties, commercial spaces, or pre-construction developments, the potential for substantial returns makes Brazil an increasingly attractive destination for real estate capital.

Key Takeaways

- Rental yields in Brazil’s major markets typically range from 6-12% annually , significantly higher than many developed markets

- Pre-construction purchases can offer appreciation of 20-40% from groundbreaking to completion in high-growth areas

- Florianópolis and coastal regions are experiencing exceptional growth, with some neighborhoods showing double-digit annual appreciation

- Tax considerations and legal structures significantly impact net ROI, requiring careful planning

- Currency fluctuations create opportunities for foreign investors but require hedging strategies

Understanding the ROI of Real Estate Investments in Brazil

Return on Investment (ROI) in Brazilian real estate encompasses multiple revenue streams and appreciation factors that work together to create overall returns. Unlike single-metric markets, Brazil’s diverse economy and regional variations mean that ROI calculations must account for rental income, capital appreciation, tax implications, and currency considerations .

Components of Real Estate ROI in Brazil

The total return on property investments in Brazil typically includes:

Rental Income (Yield) 💰

- Gross rental yields averaging 6-8% in major cities

- Premium locations achieving 10-12% yields

- Short-term vacation rentals generating even higher returns in tourist areas

Capital Appreciation 📈

- Historical appreciation rates of 8-15% annually in growth markets

- Pre-construction opportunities offering exceptional value appreciation

- Infrastructure development driving localized appreciation spikes

Tax Benefits

- Depreciation deductions reducing taxable income

- Specific investment structures minimizing tax burden

- Regional incentives in developing areas

Currency Advantages

- Brazilian Real (BRL) fluctuations creating entry opportunities

- Dollar-based investors benefiting from favorable exchange rates

- Rental income in local currency with potential appreciation

Current Market Conditions Affecting ROI in 2025

Brazil’s real estate market in 2025 presents a unique convergence of favorable conditions that directly impact investment returns. The real estate market in Greater Florianópolis is experiencing significant growth , exemplifying broader national trends.

Economic Factors Influencing Returns

Interest Rate Environment

Brazil’s central bank policies in 2025 have created an interesting dynamic for real estate investors. While mortgage rates remain higher than developed markets, they’ve stabilized, making property financing more predictable. The current SELIC rate influences both borrowing costs and the attractiveness of real estate versus fixed-income alternatives.

Inflation and Property Values

Brazilian real estate has historically served as an effective inflation hedge , with property values typically appreciating at rates exceeding official inflation metrics. In 2025, this characteristic remains particularly valuable as investors seek assets that preserve purchasing power.

Regional Performance Variations

| Region | Average Rental Yield | Annual Appreciation | Investment grade |

|---|---|---|---|

| São Paulo | 6-8% | 8-12% | THE |

| Rio de Janeiro | 7-9% | 6-10% | B+ |

| Florianópolis | 8-12% | 12-18% | A+ |

| Brasilia | 6-7% | 7-9% | B |

| Porto Alegre | 7-9% | 8-11% | THE- |

The data clearly shows that coastal markets, particularly Florianópolis, are delivering superior returns across both yield and appreciation metrics. This performance is driven by tourism growth, remote work migration, and infrastructure investment.

Calculating the ROI of Real Estate Investments in Brazil

Accurate ROI calculation requires understanding both simple and complex metrics that reflect the true performance of Brazilian property investments.

Simple ROI Formula

The basic calculation for annual ROI is:

ROI = (Annual Net Income + Appreciation) / Total Investment × 100

For example, a property purchased for R$500,000 that generates R$40,000 in annual net rental income and appreciates by R$50,000 would yield:

ROI = (R$40,000 + R$50,000) / R$500,000 × 100 = 18% annual return

Advanced ROI Metrics

Cash-on-Cash Return

This metric measures the annual return based on actual cash invested (excluding financed portions):

Cash-on-Cash = Annual Pre-Tax Cash Flow / Total Cash Invested

Internal Rate of Return (IRR)

IRR accounts for the time value of money and multiple cash flows over the investment period, providing a more sophisticated view of returns, particularly for properties held 5+ years.

Cap Rate (Capitalization Rate)

Cap Rate = Net Operating Income / Property Value

This metric helps compare properties and markets independently of financing structures.

Real-World ROI Example: Florianópolis Studio

Consider investing in studios in Florianópolis , a popular strategy for maximizing returns:

- Purchase Price : R$350,000 (pre-construction)

- Down Payment : R$105,000 (30%)

- Annual Rental Income : R$36,000 (R$3,000/month)

- Annual Expenses : R$8,000 (taxes, maintenance, management)

- Net Annual Income : R$28,000

- 3-Year Appreciation : R$70,000 (20%)

Cash-on-Cash Return : R$28,000 / R$105,000 = 26.7% annually

Total 3-Year ROI : (R$84,000 income + R$70,000 appreciation) / R$105,000 = 146.7%

This example demonstrates why pre-construction properties can significantly amplify returns compared to purchasing completed units.

Best Locations for Maximizing ROI of Real Estate Investments in Brazil

Location selection fundamentally determines investment success in Brazilian real estate. The best places to invest in Brazil property share common characteristics: strong economic fundamentals, population growth, infrastructure development, and tourism appeal.

Florianópolis: The Rising Star ⭐

Florianópolis has emerged as Brazil’s premier investment destination for several compelling reasons:

Growth Drivers

- Technology sector expansion attracting high-income professionals

- Remote work migration from São Paulo and other major cities

- Tourism infrastructure investment

- Quality of life and infrastructure development in neighborhoods like English

Investment Performance

- Rental yields: 8-12% annually

- Capital appreciation: 12-18% annually

- Occupancy rates: 85-95% year-round

- Strong vacation rental market supplementing long-term rentals

The sales performance transforming Florianópolis’s real estate market in 2025 reflects unprecedented demand and investor confidence.

São Paulo: Stable Returns

Brazil’s economic powerhouse offers:

- Consistent rental demand from corporate sector

- Diverse neighborhood options at various price points

- Lower volatility compared to emerging markets

- Strong legal and property management infrastructure

Rio de Janeiro: Tourism-Driven Opportunities

Rio’s investment appeal centers on:

- International tourism creating vacation rental demand

- Iconic locations commanding premium prices

- Ongoing urban renewal projects

- Olympic infrastructure legacy

Emerging Markets

Secondary cities like Curitiba, Belo Horizonte, and Recife offer:

- Lower entry prices

- Growing middle-class demand

- Less competition from institutional investors

- Higher risk but potentially higher returns

Strategies for Optimizing Your Brazilian Real Estate ROI

Maximizing returns requires strategic approaches tailored to Brazil’s unique market characteristics.

Pre-Construction Investment Strategy

Purchasing properties during the construction phase offers several advantages:

✅ Lower Entry Prices : Developers offer discounts of 15-30% below market value

✅ Payment Plans : Extended payment schedules reducing upfront capital requirements

✅ Appreciation During Construction : Properties typically appreciate 20-40% from groundbreaking to completion

✅ Customization Options : Ability to select finishes and layouts that maximize rental appeal

Recent construction progress at developments like Tramonto demonstrates the tangible progress investors can monitor throughout the construction cycle.

Value-Add Renovations

Purchasing older properties and implementing strategic renovations can generate exceptional returns:

- Kitchen and bathroom upgrades yielding 150-200% ROI

- Energy efficiency improvements reducing operating costs

- Smart home technology increasing rental appeal

- Cosmetic improvements enabling 20-40% rent increases

Short-Term Rental Optimization

Brazil’s tourism industry creates opportunities for vacation rental income:

Platforms : Airbnb, Booking.com, VRBO dominating the market

Peak Season Rates : 200-300% higher than long-term rental rates

Management : Professional property management services handling operations

Regulations : Understanding local short-term rental laws and licensing requirements

Portfolio Diversification

Sophisticated investors diversify across:

- Property Types : Residential, commercial, mixed-use

- Locations : Multiple cities and neighborhoods

- Investment Stages : Pre-construction, completed, value-add

- Tenant Profiles : Students, professionals, tourists, families

Tax Implications and Legal Considerations

Understanding Brazil’s tax framework is essential for calculating true net ROI and structuring investments optimally.

Tax Structure for Real Estate Investors

Rental Income Taxation

- Individual investors: Progressive rates up to 27.5%

- Corporate structures: Flat rates potentially lower for high-income properties

- Deductible expenses: Maintenance, property management, depreciation

Capital Gains Tax

- 15% on profits from property sales (individuals)

- Examples available for primary residences under certain conditions

- Holding period considerations affecting tax treatment

Property Tax (IPTU)

- Annual municipal tax based on property value

- Rates varying by location: 0.5-1.5% of assessed value

- Deductible from rental income for tax purposes

Foreign Investment Considerations

International investors face additional requirements:

📋 CPF Registration : Brazilian tax identification number required

📋 Legal Structure : Choosing between individual ownership and corporate entities

📋 Currency Controls : Understanding regulations for fund transfers

📋 Repatriation : Rules governing profit and capital repatriation

Legal Due Diligence

Essential legal steps include:

- Title verification and lien searches

- Zoning and usage rights confirmation

- Condominium regulation review

- Environmental compliance verification

- Construction permits validation for new developments

Risks and Mitigation Strategies

While Brazilian real estate offers attractive returns, understanding and managing risks is crucial for protecting ROI.

Market Risks

Economic Volatility 📊

Brazil’s economy experiences cyclical fluctuations affecting property values and rental demand. Mitigation strategies include:

- Focusing on supply-constrained markets

- Diversifying across regions

- Maintaining cash reserves for vacancy periods

- Selecting properties with strong fundamental demand

Currency Risk 💱

The Brazilian Real’s volatility creates both opportunities and risks for foreign investors:

Mitigation Approaches:

- Natural hedging through local currency income

- Strategic timing of currency conversions

- Derivative instruments for large positions

- Long-term perspective reducing short-term volatility impact

Property-Specific Risks

Construction Delays

Pre-construction investments face completion timeline risks:

- Selecting established developers with track records

- Reviewing financial guarantees and insurance

- Understanding contractual remedies for delays

- Monitoring construction progress through regular updates

Vacancy Risk

Periods without tenants directly impact cash flow:

- Location selection in high-demand areas

- Competitive pricing strategies

- Professional property management

- Diversification across multiple units

Maintenance and Unexpected Costs

Brazilian properties may require more maintenance than anticipated:

- Reserve funds of 10-15% of annual income

- Quality construction reducing long-term costs

- Regular preventative maintenance programs

- Comprehensive insurance coverage

Regulatory and Political Risks

Brazil’s regulatory environment can change, affecting property investments:

Zoning Changes : Monitoring local development plans

Rent Control : Understanding tenant protection laws

Tax Policy : Staying informed about legislative changes

Political Stability : Diversifying investments to reduce concentration risk

Financing Options and Leverage Strategies

Strategic use of financing can significantly amplify ROI on Brazilian real estate investments.

Domestic Financing

Mortgage Options for Residents

- Loan-to-value ratios: 50-80%

- Interest rates: 8-12% annually (2025 rates)

- Terms: 15-30 years

- Requirements: Proof of income, credit history, down payment

Developer Financing

- Often more flexible than bank mortgages

- Extended payment plans during construction

- Lower down payment requirements

- Interest rates built into pricing

International Financing

Foreign investors face more limited financing options:

- Higher down payment requirements (40-50%)

- Premium interest rates

- Additional documentation requirements

- Currency risk considerations

Leverage Impact on ROI

Example: Leveraged vs. All-Cash Purchase

All-Cash Scenario:

- Investment: R$500,000

- Annual net income: R$40,000

- Cash-on-cash return: 8%

Leveraged Scenario (50% LTV):

- Cash investment: R$250,000

- Loan: R$250,000 at 10% interest

- Annual net income: R$40,000

- Annual interest: R$25,000

- Net cash flow: R$15,000

- Cash-on-cash return: 6%

However, the leveraged scenario includes:

- Main paydown building equity

- Appreciation on full R$500,000 value

- Tax deductions on interest payments

- Capital freed for additional investments

When accounting for these factors, leveraged returns often exceed all-cash returns for experienced investors.

Working with Professional Partners

Successful real estate investment in Brazil typically requires a team of qualified professionals.

Essential Professional Partners

Real Estate Developers 🏗️

Reputable developers like Quadragon offer:

- Quality construction and timely delivery

- Transparent communication and progress updates

- Diverse property options tailored to investment goals

- Post-sale support and services

Property Managers

Professional management services provide:

- Tenant screening and placement

- Rent collection and accounting

- Maintenance coordination

- Legal compliance

- Typical fees: 8-12% of monthly rent

Legal Advisors

Specialized real estate attorneys handle:

- Purchase contract review

- Title verification

- Tax structure optimization

- Dispute resolution

Tax Accountants

Brazilian tax specialists ensure:

- Proper declaration of income and assets

- Optimization of deductions

- Compliance with reporting requirements

- Strategic tax planning

Selecting Quality Developments

When evaluating new developments, consider:

✓ Developer Track Record : Completed projects and reputation

✓ Location Fundamentals : Growth trajectory and infrastructure

✓ Construction Quality : Materials, design, and finishes

✓ Amenities : Features enhancing rental appeal and value

✓ Legal Documentation : Permits, approvals, and guarantees

Developments like Solis and Tramonto exemplify quality projects offering strong ROI potential through strategic location selection and premium construction.

Future Outlook: ROI of Real Estate Investments in Brazil Through 2030

Understanding future trends helps investors position portfolios for optimal long-term returns.

Demographic Trends

Urbanization Acceleration

- 90% of Brazilians expected to live in urban areas by 2030

- Continued migration to economic centers

- Demand for urban housing outpacing supply

Middle Class Expansion

- Growing purchasing power increasing housing demand

- First-time homebuyer market expansion

- Rental demand from aspirational middle class

Aging Population

- Increasing demand for accessible, low-maintenance properties

- Senior housing opportunities

- Multi-generational living arrangements

Technology and Innovation

PropTech Revolution 💻

Technology is transforming Brazilian real estate:

- Virtual tours and remote purchasing

- Blockchain for property transactions

- Smart home integration

- Cryptocurrency integration in real estate development

Sustainable Development

Green building practices affecting ROI:

- Energy-efficient properties commanding premium rents

- LEED certification increasing property values

- Solar power reducing operating costs

- Water conservation systems

Infrastructure Investment

Government and private infrastructure projects drive property appreciation:

Transportation Networks

- Metro expansions in major cities

- Airport improvements boosting tourism

- Highway development connecting regions

Digital Infrastructure

- 5G rollout enabling remote work

- Fiber optic expansion

- Smart city initiatives

Market Predictions for 2025-2030

Conservative Scenario:

- Annual appreciation: 6-8%

- Rental yields: 5-7%

- Total returns: 11-15%

Moderate Scenario:

- Annual appreciation: 8-12%

- Rental yields: 6-9%

- Total returns: 14-21%

Optimistic Scenario:

- Annual appreciation: 12-18%

- Rental yields: 8-12%

- Total returns: 20-30%

Most analysts expect performance between moderate and optimistic scenarios for well-selected properties in growth markets like Florianópolis.

Conclusion: Maximizing Your ROI of Real Estate Investments in Brazil

The ROI of Real Estate Investments in Brazil presents compelling opportunities for investors seeking attractive returns, portfolio diversification, and exposure to one of the world’s most dynamic emerging markets. With rental yields consistently exceeding those in developed markets, strong appreciation potential in growth regions, and favorable entry points for foreign investors, Brazilian real estate deserves serious consideration in any sophisticated investment strategy.

Success in this market requires:

🎯 Strategic Location Selection : Focusing on high-growth markets like Florianópolis with strong fundamentals

🎯 Professional Partnerships : Working with experienced developers and local experts

🎯 Comprehensive Due Diligence : Understanding legal, tax, and market factors

🎯 Long-Term Perspective : Allowing time for appreciation and compound returns

🎯 Risk Management : Diversification and professional property management

Next Steps for Prospective Investors

1. Research and Education

- Explore current market conditions and trends

- Understand regional differences and opportunities

- Learn about legal and tax frameworks

2. Define Investment Criteria

- Establish return objectives and risk tolerance

- Determine investment timeline and liquidity needs

- Set budget parameters and financing strategy

3. Explore Available Properties

- Review quality developments in target markets

- Compare pre-construction and completed options

- Evaluate location, amenities, and developer reputation

4. Engage Professional Partners

- Contact experienced real estate professionals

- Consult with legal and tax advisors

- Establish property management relationships

5. Execute and Monitor

- Conduct thorough due diligence on selected properties

- Structure purchase optimally for tax efficiency

- Implement ongoing performance monitoring

The Brazilian real estate market in 2025 offers a unique convergence of favorable conditions: economic stabilization, infrastructure investment, demographic trends, and attractive valuations. For investors willing to navigate the market’s complexities with professional guidance and strategic planning, the potential for exceptional returns remains strong.

Whether you’re seeking passive rental income, long-term capital appreciation, or a combination of both, understanding and optimizing the ROI of Real Estate Investments in Brazil positions you to capitalize on one of Latin America’s most promising investment opportunities. The time to explore these opportunities is now, as Brazil’s growth trajectory continues to attract sophisticated investors from around the world.

References

[1] Brazilian Central Bank – Real Estate Market Statistics 2025

[2] IBGE (Brazilian Institute of Geography and Statistics) – Urbanization Trends Report

[3] FipeZap Index – Property Price Appreciation Data

[4] Brazilian Real Estate Chamber (CBIC) – Market Analysis 2025

[5] Ministry of Economy – Foreign Investment Regulations

[6] Federal Revenue – Tax Guidelines for Real Estate Investors

[7] World Bank – Brazil Economic Outlook 2025