Brazil’s Northeast region is experiencing an unprecedented real estate transformation in 2026, with Salvador and Recife leading the charge through massive infrastructure investments. The Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 represents one of the most compelling investment opportunities in Latin American real estate today. These secondary cities are outpacing traditional powerhouses like São Paulo and Rio de Janeiro, driven by the federal government’s ambitious Novo PAC (Programa de Aceleração do Crescimento) urban mobility initiatives.

The numbers tell a remarkable story. Salvador has recorded a 20.85% annual increase in property values over the 12-month period from May 2024 to May 2025, making it the fastest-growing capital in Brazil[3]. Meanwhile, Recife’s strategic position as a regional economic hub, combined with significant transit infrastructure improvements, has positioned the city for substantial appreciation. Together, these cities represent a new frontier for property investors seeking high returns in emerging markets.

Key Takeaways

- 🚇 Salvador leads Brazil with 20.85% annual property value growth, the highest rate among all Brazilian capitals, driven by Novo PAC transit investments[3]

- 📈 Property values in premium neighborhoods like Barra increased 20.6% in one year, with transit-adjacent areas commanding significant premiums[5]

- 🏗️ Five-year growth projections estimate 50-60% total appreciation in Salvador, representing compound annual growth rates between 8.5% and 10%[3]

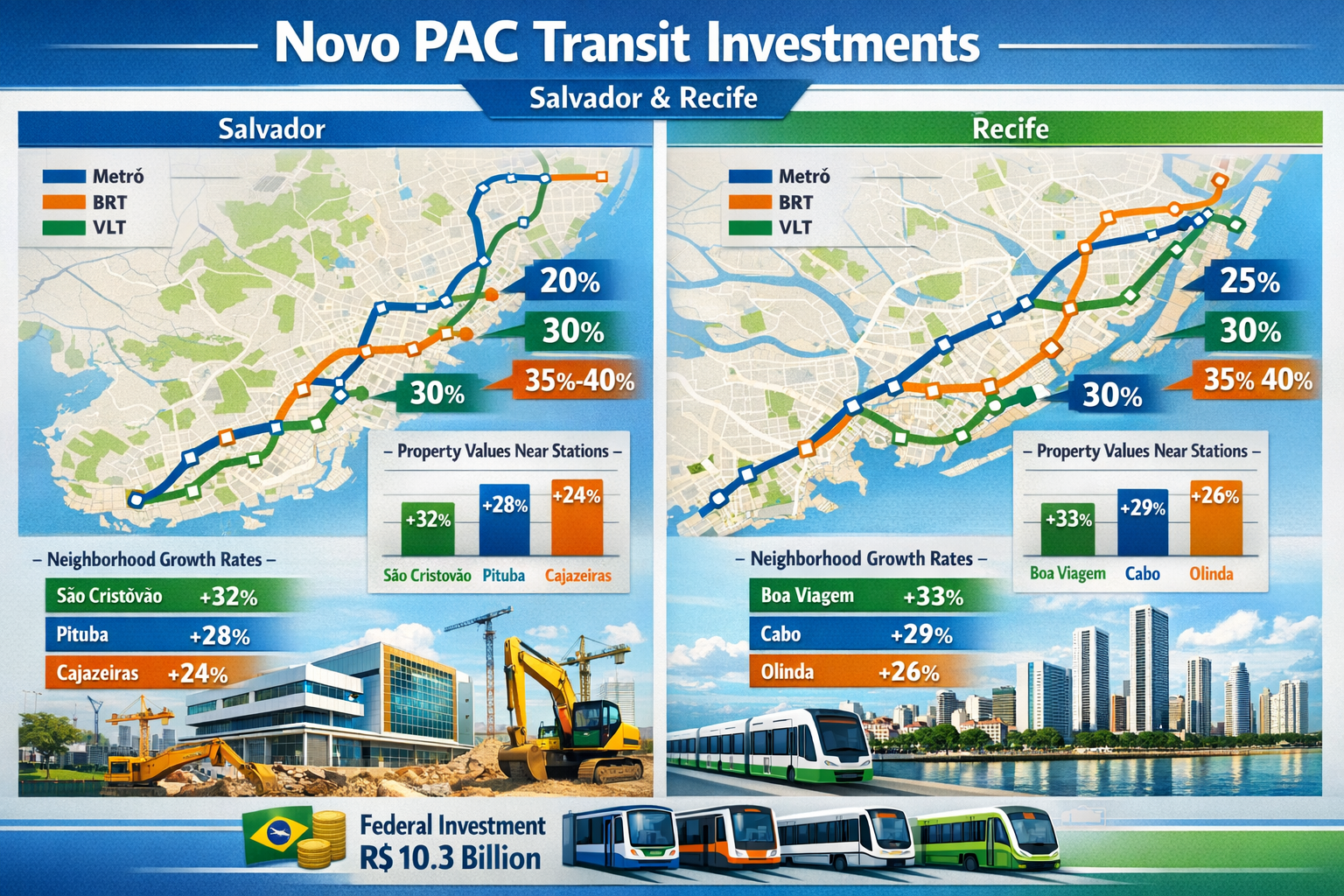

- 🚊 Novo PAC urban mobility projects are transforming Northeast cities with new metro lines, BRT corridors, and VLT systems creating accessibility premiums

- 💰 Secondary cities like Salvador and João Pessoa show growth above 20%, far outpacing traditional markets and creating opportunities for mid-tier residential developers[4]

Understanding the Novo PAC Transit Revolution in Northeast Brazil

The Novo PAC (New Growth Acceleration Program) represents the Brazilian federal government’s most ambitious infrastructure investment initiative in over a decade. Launched with a focus on urban mobility, the program has allocated billions of reais to transform transportation networks in secondary cities across Brazil’s Northeast region.

What Makes Novo PAC Different?

Unlike previous infrastructure programs that primarily benefited major metropolitan areas like São Paulo and Rio de Janeiro, Novo PAC specifically targets secondary cities with high growth potential. Salvador and Recife emerged as priority destinations due to their:

- Strategic regional importance as economic and cultural hubs

- Growing middle-class populations demanding better transportation

- Existing infrastructure gaps that create immediate impact opportunities

- Tourism potential that benefits from improved connectivity

The program’s urban mobility component includes:

✅ Metro line expansions connecting suburbs to city centers

✅ Bus Rapid Transit (BRT) corridors with dedicated lanes

✅ Light Rail Transit (VLT) systems for historic districts

✅ Integrated fare systems improving accessibility

✅ Station area development encouraging mixed-use projects

The Transit-Property Value Connection

Research consistently shows that proximity to quality public transportation increases property values by 10-40% depending on the market. In Salvador and Recife, this premium is particularly pronounced because:

- Limited previous transit infrastructure means the impact is more dramatic

- Car ownership costs in Brazil make transit access highly valuable

- Urban congestion in both cities creates strong demand for alternatives

- Tourism and business travel benefit from reliable connections

Properties within 500 meters of metro stations command the highest premiums, while those within 1 kilometer of BRT corridors show measurable appreciation. Developers focusing on these transit-oriented development (TOD) zones are seeing exceptional returns.

For investors looking to understand best places to invest in Brazil property for high returns, Salvador and Recife’s transit-driven growth represents a compelling case study in infrastructure-led appreciation.

Salvador’s Explosive Growth: Leading Brazil’s Property Market in 2026

Salvador, the capital of Bahia state, has emerged as Brazil’s fastest-growing property market in 2026. The city’s combination of cultural richness, coastal beauty, and now world-class transit infrastructure has created perfect conditions for sustained appreciation.

Record-Breaking Growth Metrics

The data supporting Salvador’s property surge is remarkable:

- 20.85% annual increase from May 2024 to May 2025, the highest among all Brazilian capitals[3]

- June 2025 average housing price: R$ 7,449 per square meter, up from R$ 6,161 the previous year[3]

- 16.38% growth in 2023-2024, following a 5.77% increase in 2023[3]

- Five-year projected growth of 50-60%, representing compound annual rates of 8.5-10%[3]

These numbers significantly outpace Brazil’s inflation rate and represent real, inflation-adjusted gains for property owners and investors.

Neighborhood-Level Analysis: Where the Growth Is Happening

| Neighborhood | 2024-2025 Growth | Average Price/m² | Transit Access |

|---|---|---|---|

| Barra | 20.6% | R$ 9,200+ | Metro + BRT |

| Ondina | 18.3% | R$ 8,500+ | Metro planned |

| Pituba | 17.8% | R$ 7,800+ | BRT corridor |

| Rio Vermelho | 16.2% | R$ 7,200+ | VLT connection |

| Caminho das Árvores | 15.9% | R$ 8,100+ | Metro station |

Barra, Salvador’s most prestigious neighborhood, saw 20.6% growth in the past year, making it the priciest area in the city[5]. The neighborhood’s combination of beachfront location, commercial development, and direct metro access creates exceptional demand.

Novo PAC Projects Transforming Salvador

Several key transit projects are driving Salvador’s property surge:

🚇 Metro Line 2 Extension: Connecting Lauro de Freitas to the city center, opening previously isolated suburban areas to development

🚌 BRT Lapa-Aquidabã Corridor: A 14-kilometer dedicated bus lane serving 150,000 daily passengers

🚊 VLT Historic Center: Light rail connecting colonial districts to modern business areas

🏗️ Integrated Terminal Upgrades: Four major terminals receiving complete renovations

The Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 is particularly evident along these corridors, where developers are launching mid-tier residential projects targeting the growing middle class.

Developer Case Study: Mid-Tier Residential Success

One prominent developer launched a 240-unit residential complex in Pituba, 400 meters from a new BRT station. The project featured:

- Two-bedroom units averaging 65 square meters

- Launch price: R$ 450,000 (approximately R$ 6,923/m²)

- Current resale value: R$ 585,000 (approximately R$ 9,000/m²)

- 30% appreciation in 18 months

This represents the type of opportunity available to developers and investors who understand the transit-property connection. Similar to strategies employed in valorizacao para quem compra na planta, buying pre-construction near transit infrastructure amplifies returns.

The Tourism Factor

Salvador receives 3.5 million tourists annually, and improved transit infrastructure makes the city more accessible and attractive. Properties marketed as short-term rentals near metro stations and tourist districts command premium rates, with occupancy rates exceeding 75% year-round.

Recife’s Strategic Position: The Northeast’s Economic Powerhouse

While Salvador leads in growth percentage, Recife offers unique advantages as the economic and technological hub of Northeast Brazil. The city’s property market combines steady appreciation with lower entry prices, creating opportunities for diverse investor profiles.

Recife’s Market Fundamentals

Recife ranked 62nd globally on the Property Prices Index 2026 at 15.3, positioning it between Bishkek, Kyrgyzstan (15.4) and Merida, Mexico (15.2)[2]. This relatively low global ranking indicates significant upside potential as the city develops.

Properties listed in February 2026 range from R$ 777,492 to R$ 15,900,000, offering options for various investment strategies[1]. The average property price remains below Salvador’s, providing a value entry point for investors seeking Northeast exposure.

Novo PAC Transit Infrastructure in Recife

Recife’s transit transformation includes:

🚇 Metro Sul Extension: Connecting southern suburbs to the integrated network

🚌 BRT Norte-Sul Corridor: 22-kilometer dedicated lane serving 200,000+ daily riders

🚊 VLT Waterfront Project: Light rail along the historic Capibaribe River

🌉 Bridge and Viaduct Upgrades: Reducing congestion and improving flow

The Metro Sul Extension particularly impacts property values in previously underserved areas like Imbiribeira and Boa Viagem, where developers are launching projects targeting young professionals and families.

Premium Neighborhoods and Access Premiums

Recife’s property market shows clear transit access premiums:

Boa Viagem 🏖️

- Beach neighborhood with metro access

- Average price: R$ 6,800/m²

- 15-18% annual appreciation near stations

- High demand from domestic and international buyers

Pina 🌆

- Waterfront district with VLT connection

- Average price: R$ 6,200/m²

- 14-16% annual growth

- Mixed-use development boom

Casa Forte 🏡

- Upscale residential area

- Average price: R$ 7,500/m²

- 12-15% annual appreciation

- Family-oriented developments

Imbiribeira 🏗️

- Emerging area near Metro Sul

- Average price: R$ 5,400/m²

- 18-22% growth potential

- Developer focus area

Developer Case Study: Transit-Oriented Development

A mid-sized developer completed a mixed-use project in Imbiribeira featuring:

- 180 residential units (studios to three-bedroom)

- 12 commercial spaces on ground floor

- Direct pedestrian connection to Metro Sul station

- Launch price: R$ 380,000 average per unit

- Current value: R$ 495,000 average per unit

- 30% appreciation in 24 months

This project exemplifies how transit-oriented development creates value beyond simple proximity. Integrated design that connects directly to transit infrastructure commands premium pricing.

The Technology and Education Advantage

Recife hosts Porto Digital, one of Latin America’s largest technology parks, employing over 10,000 professionals. This concentration of high-income workers creates sustained demand for quality housing near transit corridors.

Additionally, major universities including Universidade Federal de Pernambuco (UFPE) generate demand for student housing and young professional apartments near metro lines.

Comparing Salvador and Recife: Investment Strategies for Different Goals

Understanding the distinct characteristics of each market helps investors align opportunities with their goals. The Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 manifests differently in each city.

Growth vs. Value: Market Positioning

Salvador: High-Growth, Premium Market

✅ Higher absolute growth rates (20%+)

✅ Higher entry prices (R$ 7,449/m² average)

✅ Tourism-driven rental income potential

✅ Premium coastal neighborhoods

✅ Strong international buyer interest

Recife: Value Entry, Steady Appreciation

✅ Lower entry prices (R$ 5,500-6,800/m² typical)

✅ Steady 12-18% growth rates

✅ Technology sector employment base

✅ Diverse neighborhood options

✅ Strong domestic demand

Investment Strategy Matrix

| Investor Profile | Recommended City | Strategy | Expected Return |

|---|---|---|---|

| High-Net-Worth | Salvador | Premium Barra properties | 18-25% annually |

| Mid-Tier Developer | Both | Transit-adjacent residential | 20-35% project return |

| Value Investor | Recife | Emerging neighborhoods | 15-22% annually |

| Short-Term Rental | Salvador | Tourist district apartments | 8-12% yield + appreciation |

| Long-Term Hold | Both | Diversified portfolio | 50-60% over 5 years |

Risk Considerations

While both markets show strong fundamentals, investors should consider:

⚠️ Construction Delays: Novo PAC projects may face timeline extensions

⚠️ Economic Volatility: Brazil’s broader economic conditions affect demand

⚠️ Oversupply Risk: Rapid development could temporarily saturate markets

⚠️ Currency Fluctuation: International investors face real/dollar exchange risk

Diversification across both cities and multiple neighborhoods reduces concentration risk while maintaining exposure to the Northeast growth story.

The Broader Brazilian Context: Why Secondary Cities Are Outperforming

The Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 is part of a larger trend across Brazil. Secondary cities are leading price growth, with increases above 20% far outpacing São Paulo and Rio de Janeiro[4].

National Market Dynamics

Brazil’s average house price stands at approximately R$ 650,000 (about $117,000) as of early 2026[4], making property relatively affordable compared to developed markets. However, this national average masks significant regional variation.

Secondary cities like Salvador and João Pessoa demonstrate that growth opportunities have shifted from traditional metros to emerging markets with:

- Infrastructure investment creating new accessibility

- Lower baseline prices allowing greater appreciation percentages

- Population growth from internal migration

- Quality of life advantages attracting remote workers

Brazil’s Housing Market Resilience

Despite high interest rates, Brazil’s housing market has defied expectations by outrunning inflation[6]. This resilience stems from:

💪 Structural housing deficit creating sustained demand

💪 Middle-class expansion increasing purchasing power

💪 Government programs supporting first-time buyers

💪 Infrastructure investment improving livability

For context on how Brazilian markets are performing, the mercado imobiliário shows similar dynamics in other regions.

Comparative Growth Rates

| City | 2024-2025 Growth | 5-Year Projection | Transit Investment |

|---|---|---|---|

| Salvador | 20.85% | 50-60% | High |

| João Pessoa | 20%+ | 45-55% | Medium |

| Recife | 15-18% | 40-50% | High |

| São Paulo | 8-10% | 25-30% | Mature |

| Rio de Janeiro | 7-9% | 20-25% | Mature |

The data clearly shows that infrastructure investment in secondary cities generates superior returns compared to established markets where transit networks are already mature.

Transit Access Premiums: Quantifying the Novo PAC Impact

Understanding the specific premium that transit access commands helps investors and developers make informed decisions about location and pricing.

Distance-Based Premium Analysis

Research in Salvador and Recife reveals clear distance-based premiums:

0-300 meters from station: 30-40% premium over comparable properties without transit access

300-500 meters: 20-30% premium

500-800 meters: 10-20% premium

800-1,000 meters: 5-10% premium

Beyond 1,000 meters: Minimal premium

These premiums apply to both sales prices and rental rates, making transit-adjacent properties attractive for both appreciation and income strategies.

Premium by Transit Type

Not all transit infrastructure creates equal value:

🚇 Metro Stations: Highest premium (30-40%) due to reliability, frequency, and comfort

🚌 BRT Corridors: Medium premium (20-30%) offering dedicated lanes and frequent service

🚊 VLT Lines: Medium premium (15-25%) popular in historic and tourist districts

🚌 Regular Bus Routes: Low premium (5-10%) subject to traffic congestion

Developers focusing on metro-adjacent projects capture the highest premiums, while BRT corridors offer excellent value for mid-tier residential development.

Time-Based Appreciation Patterns

Properties near announced transit projects show predictable appreciation patterns:

📅 Announcement Phase: 5-8% immediate increase as speculation begins

📅 Construction Phase: 10-15% gradual appreciation as completion approaches

📅 Opening Phase: 15-25% acceleration in the 12 months around opening

📅 Maturity Phase: 5-10% annual appreciation as area fully develops

Investors who enter during the announcement or early construction phase capture the most significant total returns, similar to strategies in valorizacao para quem compra na planta.

Developer Opportunities: Mid-Tier Residential Projects

The Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 creates exceptional opportunities for developers focusing on mid-tier residential projects.

Target Market Demographics

Northeast Brazil’s growing middle class represents the ideal market for mid-tier development:

👥 Young professionals (25-40 years old)

👥 Dual-income families with household income R$ 8,000-20,000/month

👥 First-time buyers seeking quality and location

👥 Investors looking for rental income properties

This demographic values:

✅ Transit accessibility for work commutes

✅ Modern amenities including fitness centers and coworking spaces

✅ Security features such as gated access and monitoring

✅ Efficient layouts maximizing space in 50-80m² units

Optimal Project Parameters

Successful mid-tier projects in Salvador and Recife typically feature:

Unit Mix:

- 40% studios and one-bedroom (45-55m²)

- 45% two-bedroom (60-75m²)

- 15% three-bedroom (80-95m²)

Pricing:

- Launch prices: R$ 350,000-650,000

- Price per m²: R$ 6,500-8,500

- Payment plans: 20-30% down, 24-36 month construction payments

Amenities:

- Rooftop leisure area

- Fitness center

- Coworking space

- Bike storage

- Ground-floor retail

Location Criteria:

- Within 500m of metro/BRT station

- Mixed-use neighborhood

- Established commercial infrastructure

- School and healthcare access

Financial Modeling

A typical 200-unit mid-tier project in Recife near Metro Sul:

Development Costs:

- Land acquisition: R$ 8 million

- Construction: R$ 45 million

- Marketing and sales: R$ 3 million

- Total: R$ 56 million

Revenue:

- Average unit price: R$ 480,000

- Total units: 200

- Gross revenue: R$ 96 million

Returns:

- Gross profit: R$ 40 million

- Profit margin: 71%

- ROI: 71% over 36-month project

These returns significantly exceed typical development projects in mature markets, demonstrating why developers are focusing on transit-adjacent opportunities in Salvador and Recife.

Risk Mitigation Strategies

Developers can reduce project risk through:

🛡️ Phased development allowing market response assessment

🛡️ Pre-sales targets of 30-40% before construction start

🛡️ Flexible unit mix adapting to buyer preferences

🛡️ Transit timeline monitoring adjusting schedules to match infrastructure

🛡️ Local partnerships leveraging regional expertise

Investment Vehicles and Entry Strategies

Investors have multiple pathways to participate in the Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026.

Direct Property Ownership

Advantages:

✅ Full control over property decisions

✅ Direct appreciation capture

✅ Rental income potential

✅ Tangible asset ownership

Considerations:

⚠️ Higher capital requirements (R$ 350,000+ minimum)

⚠️ Property management responsibilities

⚠️ Liquidity constraints

⚠️ Local market knowledge needed

Optimal for: High-net-worth individuals, experienced real estate investors, those seeking long-term holds

Pre-Construction Purchases

Buying “na planta” (off-plan) offers significant advantages:

✅ Lower entry prices (15-25% below completion value)

✅ Payment plans during construction

✅ Appreciation during construction phase

✅ First choice of units and locations

Timeline: Typically 24-36 months from purchase to delivery

Returns: 25-40% appreciation from launch to completion in transit-adjacent projects

This strategy is detailed in valorizacao para quem compra na planta, showing how pre-construction purchases amplify returns.

Real Estate Investment Funds (FIIs)

Brazilian Fundos de Investimento Imobiliário offer diversified exposure:

✅ Lower minimum investment (R$ 10,000-50,000)

✅ Professional management

✅ Diversification across properties

✅ Monthly income distribution

✅ Liquidity through stock exchange trading

Considerations:

⚠️ Management fees (typically 1-2% annually)

⚠️ Less control over specific properties

⚠️ Market volatility affects share prices

Optimal for: Smaller investors, those seeking passive income, portfolio diversification

Joint Venture Development

Partnering with local developers provides:

✅ Access to expertise and local networks

✅ Shared risk across multiple projects

✅ Higher potential returns (20-50% annually)

✅ Active participation in decisions

Structure: Typically 30-40% equity contribution for proportional profit share

Optimal for: Experienced investors, those with development knowledge, higher risk tolerance

International Investor Considerations

Foreign investors should understand:

🌍 No restrictions on property ownership for most property types

🌍 Tax obligations including 15% capital gains tax

🌍 Currency risk from real/dollar fluctuations

🌍 Legal representation required for transactions

🌍 Remittance procedures for repatriating funds

Working with experienced legal and tax advisors is essential for international investors.

Neighborhood Selection Framework: Finding the Next Growth Areas

Identifying neighborhoods before peak appreciation requires systematic analysis. Here’s a framework for evaluating opportunities in Salvador and Recife.

Transit Infrastructure Criteria

✅ Announced projects with confirmed funding

✅ Construction timeline within 24-36 months

✅ Station locations and catchment areas

✅ Integration with existing networks

✅ Frequency and service hours planned

Neighborhoods with multiple transit modes (metro + BRT, for example) show the strongest appreciation.

Economic Activity Indicators

✅ Employment centers within 30 minutes

✅ Commercial development and retail activity

✅ Office space construction and occupancy

✅ Educational institutions attracting students

✅ Healthcare facilities serving the area

Areas showing increasing commercial activity typically precede residential appreciation by 6-12 months.

Demographic Trends

✅ Population growth exceeding city average

✅ Household income increases

✅ Age distribution favoring 25-45 demographic

✅ Education levels rising

✅ Migration patterns from other regions

Neighborhoods attracting young professionals and families sustain long-term appreciation.

Supply-Demand Balance

✅ Limited new supply relative to demand

✅ Low vacancy rates (below 5%)

✅ Absorption rates for new projects

✅ Price trends showing consistent growth

✅ Rental yields indicating demand strength

Markets with constrained supply and strong demand offer the best risk-adjusted returns.

Emerging Neighborhoods to Watch

Salvador:

- Patamares: Metro extension planned, 18-22% growth potential

- Paralela: Commercial corridor development, 15-20% growth potential

- Itaigara: Upscale area with BRT access, 14-18% growth potential

Recife:

- Imbiribeira: Metro Sul impact zone, 20-25% growth potential

- Piedade: Historic area with VLT connection, 16-20% growth potential

- Torre: Emerging residential area, 15-19% growth potential

These neighborhoods show multiple positive indicators and represent opportunities for early-stage investors.

Financing and Capital Strategies

Understanding financing options is crucial for maximizing returns on Salvador and Recife property investments.

Brazilian Mortgage Market

Brazil’s mortgage market offers several programs:

🏦 Casa Verde e Amarela: Government-subsidized program for lower-income buyers

🏦 SBPE System: Traditional bank financing at market rates

🏦 FGTS: Use of employment guarantee fund for down payments

🏦 Developer Financing: Direct payment plans during construction

Typical Terms:

- Down payment: 20-30%

- Interest rates: 9-12% annually (2026 rates)

- Terms: 15-30 years

- Income requirements: 30% debt-to-income ratio maximum

Leverage Strategies

Strategic use of leverage amplifies returns:

Example: R$ 500,000 property purchase

All-Cash Purchase:

- Investment: R$ 500,000

- 5-year appreciation (50%): R$ 750,000

- Profit: R$ 250,000

- ROI: 50%

Leveraged Purchase (30% down):

- Cash investment: R$ 150,000

- Mortgage: R$ 350,000

- 5-year appreciation (50%): R$ 750,000

- Mortgage paydown: ~R$ 50,000

- Remaining loan: R$ 300,000

- Net equity: R$ 450,000

- Profit: R$ 300,000

- ROI: 200% (on cash invested)

Leverage significantly amplifies returns but increases risk if values decline.

International Financing Options

Foreign investors typically face:

⚠️ Limited local financing availability

⚠️ Higher down payment requirements (40-50%)

⚠️ Stricter documentation standards

⚠️ Currency exchange considerations

Many international investors use:

✅ Home equity from their primary residence

✅ International portfolio loans

✅ Developer payment plans during construction

✅ All-cash purchases for simplicity

Tax Optimization

Brazilian property taxation includes:

📊 IPTU (Property Tax): 0.5-1.5% of assessed value annually

📊 Capital Gains Tax: 15% on profits from sales

📊 Rental Income Tax: Progressive rates 7.5-27.5%

📊 Transaction Tax (ITBI): 2-3% of purchase price

Optimization strategies:

- Hold properties 5+ years for reduced tax basis

- Use corporate structure for multiple properties

- Offset gains with improvement costs

- Consider 1031-style exchanges (permuta)

Professional tax advice is essential for optimizing returns.

Risks and Challenges: A Balanced Perspective

While the Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 presents compelling opportunities, investors must understand potential risks.

Infrastructure Delivery Risk

⚠️ Construction delays are common in Brazilian public projects

⚠️ Budget overruns may reduce project scope

⚠️ Political changes could affect funding priorities

⚠️ Technical challenges may extend timelines

Mitigation: Diversify across multiple transit corridors, focus on projects with construction already underway, maintain longer investment horizons.

Market Oversupply Risk

⚠️ Rapid development could temporarily saturate markets

⚠️ Speculative building without demand analysis

⚠️ Economic downturn reducing buyer capacity

Mitigation: Research absorption rates, focus on neighborhoods with diverse economic bases, avoid areas with excessive new supply.

Economic and Political Volatility

⚠️ Brazilian economic cycles affect purchasing power

⚠️ Interest rate fluctuations impact affordability

⚠️ Political instability creates uncertainty

⚠️ Currency depreciation affects international investors

Mitigation: Maintain diversified portfolios, use hedging strategies for currency risk, focus on fundamentals over speculation.

Liquidity Constraints

⚠️ Property sales take 3-6 months typically

⚠️ Market downturns extend selling timelines

⚠️ Transaction costs reduce net proceeds (8-10% total)

Mitigation: Maintain adequate cash reserves, plan for 5+ year holding periods, consider rental income as alternative to sales.

Legal and Regulatory Risks

⚠️ Title issues can complicate transactions

⚠️ Zoning changes may affect property use

⚠️ Tenant protections favor occupants

⚠️ Environmental regulations may restrict development

Mitigation: Conduct thorough due diligence, use experienced legal counsel, obtain title insurance, verify all permits and approvals.

Climate and Environmental Considerations

Both Salvador and Recife face:

⚠️ Sea level rise affecting coastal properties

⚠️ Flooding risk in low-lying areas

⚠️ Extreme weather events increasing

Mitigation: Assess elevation and flood zones, prioritize properties with climate resilience features, consider insurance costs.

Future Outlook: Beyond 2026

While current data focuses on 2026, understanding longer-term trends helps investors position for sustained success.

2027-2031 Projections

Analysts project Salvador and Recife will continue outperforming national averages through 2031:

Salvador:

- 2026-2031 projected growth: 40-50% cumulative

- Annual average: 7-9%

- Driven by: Transit network maturity, tourism growth, quality of life migration

Recife:

- 2026-2031 projected growth: 35-45% cumulative

- Annual average: 6-8%

- Driven by: Technology sector expansion, regional economic hub status, infrastructure completion

Emerging Trends to Watch

🔮 Remote Work Migration: Professionals leaving São Paulo/Rio for lower costs and better quality of life

🔮 Climate Migration: Movement from drought-affected interior regions to coastal cities

🔮 Technology Hub Development: Porto Digital expansion creating high-income employment

🔮 Tourism Infrastructure: Airport expansions and hotel development increasing visitor capacity

🔮 Sustainability Focus: Green building standards and renewable energy integration

Next-Generation Transit Projects

Beyond current Novo PAC projects, future investments may include:

🚄 High-speed rail connecting Salvador and Recife

🚇 Metro network expansions to outer suburbs

🚲 Bike-sharing systems integrated with transit

🚁 Urban air mobility for premium transport

🔌 Electric bus fleets reducing emissions

These future projects will create second-wave opportunities in currently peripheral areas.

Comparative Advantage Sustainability

Salvador and Recife’s competitive advantages appear sustainable because:

✅ Infrastructure gap still exists compared to developed markets

✅ Cost advantages remain significant vs. São Paulo/Rio

✅ Quality of life factors attract continued migration

✅ Economic diversification reduces dependence on single sectors

✅ Government commitment to Northeast development continues

The region’s growth story extends well beyond 2026, offering opportunities for patient, strategic investors.

Actionable Investment Checklist

For investors ready to participate in the Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026, here’s a practical action plan:

Research Phase (Weeks 1-4)

✅ Study transit maps and project timelines for Salvador and Recife

✅ Identify target neighborhoods using the selection framework

✅ Analyze comparable sales in target areas

✅ Review developer track records for pre-construction opportunities

✅ Understand legal requirements for property ownership

✅ Assess financing options and calculate leverage scenarios

Planning Phase (Weeks 5-8)

✅ Define investment criteria: budget, timeline, return targets

✅ Assemble professional team: lawyer, accountant, property manager

✅ Establish legal structure: individual vs. corporate ownership

✅ Arrange financing: pre-approval for mortgages or capital access

✅ Plan site visit: schedule property tours and professional meetings

✅ Review tax implications: understand obligations and optimization

Execution Phase (Weeks 9-16)

✅ Conduct site visits: tour neighborhoods and specific properties

✅ Meet with developers: review projects and payment terms

✅ Perform due diligence: title search, inspection, document review

✅ Negotiate terms: price, payment schedule, contingencies

✅ Execute contracts: with legal review and translation

✅ Arrange fund transfer: through proper channels with documentation

Management Phase (Ongoing)

✅ Monitor construction (if pre-construction purchase)

✅ Arrange property management for rentals

✅ Track market conditions and comparable sales

✅ Maintain tax compliance with annual filings

✅ Review exit strategy periodically

✅ Consider portfolio expansion with additional properties

This systematic approach reduces risk while maximizing the probability of successful outcomes.

Conclusion: Capitalizing on Northeast Brazil’s Transit-Driven Transformation

The Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 represents one of the most compelling real estate investment opportunities in Latin America today. With Salvador leading Brazil at 20.85% annual growth[3] and Recife offering value entry points with strong fundamentals, these Northeast cities are redefining Brazilian property investment.

The transformation is real and measurable. Salvador’s average property values reached R$ 7,449 per square meter in June 2025[3], with premium neighborhoods like Barra showing 20.6% annual appreciation[5]. Five-year projections estimate 50-60% total growth[3], representing compound annual returns that significantly outpace traditional investments.

Novo PAC transit infrastructure is the catalyst driving this surge. Metro extensions, BRT corridors, and VLT systems are creating 30-40% access premiums for properties within 500 meters of stations. Developers launching mid-tier residential projects in these transit-oriented development zones are achieving project returns exceeding 70%, while individual investors buying pre-construction are capturing 25-40% appreciation during the construction phase alone.

The opportunity extends beyond simple appreciation. These cities offer:

🌟 Sustainable fundamentals: Growing middle class, technology sector employment, tourism infrastructure

🌟 Multiple entry strategies: Direct ownership, pre-construction, REITs, development partnerships

🌟 Diversification benefits: Geographic and market diversification for Brazilian portfolios

🌟 Quality of life: Coastal locations, cultural richness, improving infrastructure

🌟 Long-term potential: Continued growth projected through 2031 and beyond

For investors seeking exposure to best places to invest in Brazil property, Salvador and Recife deserve serious consideration alongside traditional markets.

Next Steps for Prospective Investors

Immediate Actions:

- Download transit maps for Salvador and Recife showing Novo PAC projects

- Identify 3-5 target neighborhoods using the selection framework provided

- Connect with local real estate professionals specializing in these markets

- Review financing options and calculate investment capacity

- Schedule a site visit to tour properties and meet with developers

Within 3 Months:

- Complete due diligence on specific properties or projects

- Assemble professional team (lawyer, accountant, property manager)

- Execute first investment in target market

- Establish monitoring system for market conditions

- Plan portfolio expansion strategy

Long-Term Strategy:

- Build diversified portfolio across both cities and multiple neighborhoods

- Monitor transit project completion and adjust holdings accordingly

- Optimize tax position with professional advice

- Consider exit timing based on market cycles

- Reinvest proceeds into next-wave opportunities

The Salvador and Recife Property Surge: Novo PAC Transit Projects Driving 20-40% Value Gains by 2026 is not speculation—it’s a documented transformation driven by billions in infrastructure investment, measurable appreciation data, and sustainable demographic and economic trends. Investors who act strategically, conduct thorough research, and maintain appropriate risk management can participate in one of Brazil’s most exciting real estate growth stories.

The question is not whether these markets will continue growing, but rather how investors will position themselves to capture the opportunity. With transit projects under construction, developer activity accelerating, and appreciation data confirming the trend, the time to act is now.

References

[1] Recife – https://www.holprop.com/sale/pt/property/scr/brazil/srg/pernambuco/sct/recife/

[2] Rankings – https://www.numbeo.com/property-investment/rankings.jsp

[3] Invest In Real Estate Salvador Complete Guide Market Returns Neighborhoods – https://www.jarniascyril.com/international-real-estate/investing-brazil-real-estate/invest-in-real-estate-salvador-complete-guide-market-returns-neighborhoods/

[4] Brazil Price Forecasts – https://thelatinvestor.com/blogs/news/brazil-price-forecasts

[5] Salvador Brazil Real Estate Market – https://thelatinvestor.com/blogs/news/salvador-brazil-real-estate-market

[6] Brazils Housing Market Defies High Rates As Prices Outrun Inflation – https://www.riotimesonline.com/brazils-housing-market-defies-high-rates-as-prices-outrun-inflation/